Strong Jobs Report – Market Needs To Rest – Look For the Bid To Return Next Week

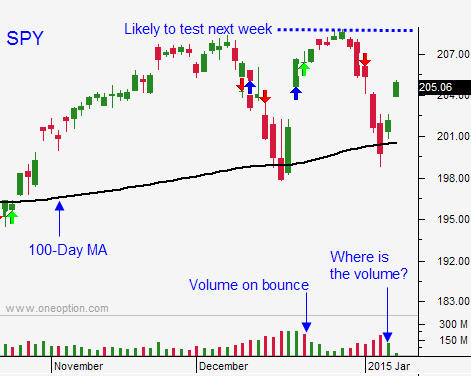

Posted 10:30 AM ET - Yesterday the market surged higher and the S&P 500 is within striking distance of the all-time high. Good news is priced in and stocks need a few days to consolidate gains. I'm expecting the all-time high to be challenged next week.

This morning we learned that 252,000 new jobs were created. That was better than expected and the unemployment rate dropped to 5.6%. Unfortunately, hourly wages fell .2%. Economists are watching this number and an increase would signal strong employment conditions. Furthermore, consumer spending would increase as workers make more money.

The calendar is bullish next week. Retail sales will be posted on Tuesday and the number should be strong. Alcoa will post results and earning season will officially begin. The week of option expiration has averaged a 1.5% gain the last four months. I believe stocks will grind higher and the S&P 500 will make a new high next week.

Corporate earnings will be strong and buybacks are at record levels. Interest rates are at historic lows and stocks are attractive relative to bonds.

Global credit concerns will loom, but they don't pose a threat during the next few weeks.

Economic conditions in Europe and China are fragile. The possibility for additional central bank easing is keeping a bid to those markets.

I have been selling out of the money January put credit spreads this week. Those positions are in nice shape and I have about 30% of my capital allocated to the strategy. Next week I will start buying them back so that I can lock in profits and reduce risk. This is my primary strategy. I still have some reservations about this rally.

I don't like the fact that the 100-day moving average was tested twice in the last month. These cycles should last longer. I also don't like the pattern of heavy volume during selloffs and light volume during rallies. The key QQQ made a lower high during the last bounce and that could be a sign that tech stocks are getting tired.

I have also been buying February call options on stocks that are breaking through horizontal resistance and that have been in an uptrend. This is only about 10% of my capital. I am going out in time to reduce time premium decay. These options also span earnings so they will retain premium.

Support at SPY $204 should hold today.

I will day trade S&P futures if we make a new low for the day after one hour of trading. I will use that low as my stop. This will provide an intraday hedge should the selling continue.

Look for the bid to return next week.

.

.

Daily Bulletin Continues...