Market Looks Weak – Selling Pressure Is Heavier Than Normal – Earnings Should Help

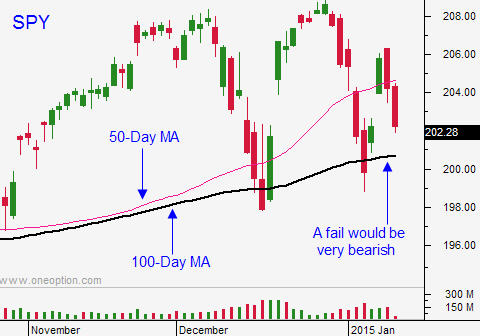

Posted 10:20 AM ET - Last week the market tested the 100-day moving average and it bounced. This has been a good entry point for long positions the last few years.

Economic numbers were strong last week (ADP, ISM manufacturing, ISM services and the Unemployment Report). Earnings season kicks off this week and that is typically bullish. Strong profits will attract buyers.

Options expiration has been bullish the last four months. The average gain the week of options expiration has been 1.5%.

China will post economic numbers tonight. I fear that they might come in a little soft, but it won't have a lasting impact on the market. Traders will be expecting the PBOC to ease. The same is true for Europe. Any economic weakness will prompt action from the ECB.

There could be looming issues on the horizon, but I believe traders will focus on corporate profits the next few weeks. I'm expecting the SPY to test the high.

Here are my concerns. In October we challenged the 200-day moving average for the first time in two years. The 100-day moving average has been challenged twice in the last month. We are seeing light volume rallies and heavy volume declines. That is also bearish.

I have bullish put spreads that expire this week and this is my primary position. As long as the market stays in this general area for another day or two, I will be in good shape. However, I want to protect the trades so I shorted the S&P futures when the SPY traded and below $204. That is also my stop.

This hedge will protect me if things get ugly and it allows me to stick with my positions. If we just chop back and forth, my put spreads will be in good shape and I will buy them back Tuesday or Wednesday.

I also own a few February calls that span earnings. This is a relatively small position. These stocks have broken through horizontal resistance and I'm using the breakout as my stop.

The price action this morning is very weak. The S&P 500 opened eight points higher and we are 10 points lower after a few minutes of trading. Typically, when the 100-day moving average has been tested and we rallied back above it, there is no looking back. This time, it doesn't feel like we are getting the same bounce.

My trading system is bearish across most stocks and ETF's and I don't want to ignore those signals. I am treading very cautiously.

If the 100-day moving average is breached this week, longer-term technical damage could be an issue. It would be a sign that selling pressure is building.

I am hedging intraday, but I am not entering new positions. If we continue to drift lower after the first hour of trading, I will start buying back some of my put spreads. My call options will take care of themselves since I have stops in place at the breakout.

.

.

Daily Bulletin Continues...