High Risk/High Reward Options Trading Strategy – I Might Use It This Week

Today's options trading strategy - If you've been following my intraday options trading strategy, you're making great money. I've been able to pull down anywhere from 8% to 15% on a daily basis. I will only trade from the long side today. I will watch the one hour range and I will note the high and the low for the first hour of trading. If the market is above the high, I will buy in the money call options. I like to use a time stop. If the position is not profitable in 5 minutes, I get out. If it is profitable, I raise the stop to my entry point. If the market is below the one hour low, I will buy call options when we cross back above it. My target is the high of the day. I also like using a time stop for this leg of the options trading strategy. Given my skepticism on the macro backdrop, this options strategy has been perfect. I have been able to participate in the rally without taking overnight risk.

If we get a decent pullback before the FOMC minutes, I might try a very risky options trading strategy. I feel that there is a possibility for a massive melt-up this week. On that pullback, I will buy out of the money February QQQ call options. This index has had better relative strength recently. If we get the squeeze I'm expecting due to options expiration and good news from the FOMC minutes/Greece, the market will take off. It is very likely that these options will expire worthless so I will not place a big bet. There is also a chance that they will increase 5 to 10 fold. That upside makes the trade worthwhile. This is highly speculative and I don't use this options strategy often. Everything has to line up for me to even try it and I feel the table is set.

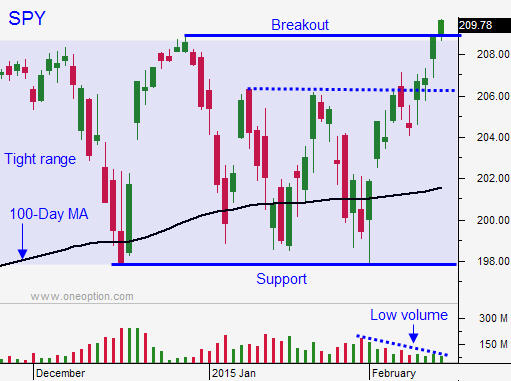

Posted 9:30 AM ET - In the last two weeks, the market has rallied from the 100-day moving average to the all-time high. All of the major indices broke out last week and this rally has a short covering feel to it. February options expire this Friday and we could see another squeeze this week.

Traders that sold out of the money call options above the all-time high will be reeling them back in. This will add fuel to the rally. The price action during the week of options expiration was strong in September, October, November and December. There are also a couple of news events that could spark buying.

The FOMC minutes will be released tomorrow afternoon. Traders have been worried that the tightening timetable will be moved forward after a strong jobs report in January. The minutes will reveal that most officials are still dovish and that tightening will happen gradually. I believe this release will be market friendly.

Greece has been digging its heels in and for some unknown reason they still feel they have the upper hand. After only four hours of negotiations, the talks ended. Greece wants to lower their budget surplus to 1.5% from the agreed-upon 4.5%. The EU might be fine with this if wage negotiations are on the table. Greece has serious structural issues. They need to secure the loan and banks are feeling the stress as depositors withdraw money.

This game of "chicken" reminds me of our debt ceiling. Both sides will wait until the last second and they will reach a deal. Unlike our situation where the government was going to shut down, they have more wiggle room. A bridge loan can be secured while talks continue. Any progress will be viewed positively by the market and we could see a big rally before they even strike a deal.

From a technical standpoint, I like breakouts that follow price consolidation. We have been in this range for three months and this could lead to a sustained run. Unfortunately, I'm not seeing the volume.

Global economic conditions are fragile. Japan's GDP rose 2.3% (4.5% expected) and that comes on the heels of a 2.2% decline and a 6.7% decline. This is the third largest economy in the world and all of the QE has not stimulated economic growth.

China's growth projections for 2015 have been lowered to 6.9%. Their trade numbers a week ago were dismal. China will celebrate the New Year and its markets will be closed for the next week. That means economic numbers will not be available until Feb 25th and this news won't stand in the way of the rally this week.

The EU only grew .3% and US growth is at 2.6%. These are not strong numbers.

Look for a nervous start to the week. Prices should firm up throughout the day.

If the market makes a new low after a few hours of trading and it can't get back above it, stay on the sidelines. We've had a big run recently and it would be natural to see a little profit-taking once the momentum is set. This pullback would be ideal from my perspective because it will give me a chance to buy some calls on support.

If I don't get the pullback, I will stick to day trading.

.

.

Daily Bulletin Continues...