Don’t Buy Feb Call Options Unless Greece Gets an Extension – FOMC Minutes Should Be Friendly

Free webinar tonight. I will highlight 2-3 trades and it will be over in 20 minutes. CLICK HERE TO REGISTER

Posted 11:30 AM ET - The market is waiting for two news events. The FOMC minutes will be released this afternoon and Greece is applying for a loan extension. Both events will play out shortly.

Many traders are worried that the Fed will remove "patient" from its statement next month. The January jobs report was very strong and the tightening timetable might have moved forward. I believe the minutes will reflect a dovish tone and this release will be market friendly.

Greece continues to dig its heels in. The new leaders want a loan extension, no strings attached. They have stated that they will dismantle the austerity programs immediately.

From what I've read, they need to reach a deal before March. Greek banks are on the ropes and deposits are declining.

I believe the EU will reach a six month agreement, but there will be closed-door meetings with European banks soon after. The ECB will force banks to write down Greek debt and to shore up balance sheets. This will give them time to brace for impact. Given the current rhetoric, I don't see Greece being part of the EU in the future.

This game of “chicken” is important because it sets precedent for other EU members like Spain.

On the macroeconomic front, US activity has hit a soft patch. Empire manufacturing, housing starts and industrial production all missed expectations. Durable goods orders, GDP, ISM manufacturing and ADP missed estimates two weeks ago. These were relatively small misses, but they are adding up.

Japan's GDP came in at 2.3% when 4.5% was expected. Massive QE has not stimulated economic growth.

European GDP rose .3% and they are barely keeping their heads above water.

China's economy has been slipping and their trade numbers were horrible. Fortunately, they are celebrating the New Year and their market is closed for a week. That means flash PMI's will be delayed until February 25th. That is good news for global markets because I sense that these numbers will be weak.

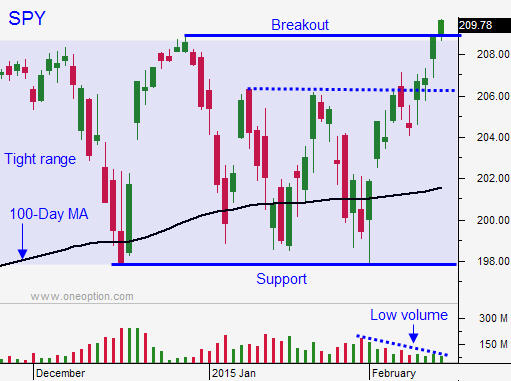

The trading activity yesterday and today has been dull. We have been stuck within a fairly tight trading range and I'm not expecting any movement before the FOMC minutes.

Greece could get word about its loan extension as soon as tomorrow. This is the major news event that we need to be watching. A move either way could spark option expiration volatility as traders adjust their risk.

I mentioned yesterday that I might be buying out of the money February call options this week because I felt a big breakout was possible. I'm getting a little gun shy and I won't trade this strategy until I hear that Greece has secured a loan. Even if the S&P 500 jumps 10 points on the news, I will buy out of the money call options. I believe that we could see a 30 point S&P move based on this news. The market is at an all-time high and further upside would force a round of short covering. Anyone who sold calls above the all-time high would get squeezed and this would fuel the move. If Greece does not secure a loan, I don't believe we will get the move even if the FOMC minutes are market friendly.

I will day trade after the FOMC minutes. If the market is making a new high for the day, I will go long. If it is making a new low, I will go short. I typically wait for 10 minutes to let some of the noise settle. There isn't much else to trade off of and this news will move the market.

The breakout is nice, but we need follow-through. If we don't get it soon, the market will fall back into its trading range.

Without momentum, I don't want to take any overnight positions. I am still in a holding pattern. If we can convincingly breakout and grind higher, I will buy some overnight calls.

Option expiration week was bullish in September, October, November and December. Given that we are at an all-time high, I believe there is a chance for a short squeeze and a rally higher.

If we can't breakout this week, my bias will turn more neutral. Let's hope for a nice rally so that we can start taking some directional trades.

.

.

Daily Bulletin Continues...