All-time Market High – Table Is Set For A Big Move – Greece, FOMC and Options Exp

TAKE MY FREE ONLINE COURSE - BULLISH PUT SPREADS. Register in the right margin of my blog. This is a powerful options trading strategy.

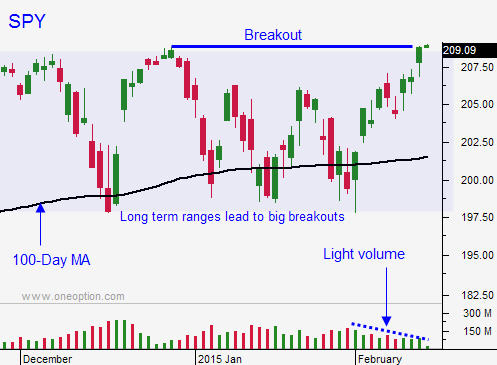

Posted 9:45 am ET - The market is making a new all-time high and the buying has been steady. After three months of consolidation, we might have gathered enough strength for a sustained rally.

I will be buying a few calls options on stocks that are breaking through horizontal resistance. I will use that breakout as my stop. I will also sell out of the money put credit spreads in February (a.k.a. Bullish put spreads). These positions will benefit from time decay over the three-day weekend.

I will only be day trading from the long side today. I will buy SPY call options above the 1 hour high. I will also buy call options if we fall below the 1 hour low and rally back above it. In this scenario I will take profits at the 1 hour high.

Traders have priced in a Greek deal. The rhetoric seems to be improving and even if they can't reach an agreement over the weekend, I don’t believe the market will tank Tuesday. There is still time next week. Once the loan is secured, the market will rejoice and the relationship will deteriorate. The new leaders have been steadfast in their fight against austerity.

The strong jobs number sparked fear that the Fed would move up there tightening timetable. I believe most members are still dovish and that will come out when the FOMC Minutes are released Wednesday. This should be market friendly event.

Options expiration has been bullish recently. We've seen big rallies and I believe we will see one next week. Anyone who sold out of the money calls above the all-time high will be forced to reel those calls back in and this will fuel the rally.

The economic news is fairly light. From a fundamental standpoint, I am still bearish. Domestic economic releases have been light. Retail sales came in worse than expected and lower gasoline prices are not stimulating consumption. GDP, durable goods, ISM manufacturing and ADP missed estimates.

The EU posted better-than-expected GDP growth. On the surface that sounds great, but their economy only grew .3%.

China's economy has been slipping steadily. Their exports were down 3.3% and imports fell 19.9%.

Earnings season has been excellent, but guidance is cautious.

Money has to go somewhere and equities are attractive relative to bonds. The selling pressure the last three months has been heavier than we've seen in a couple of years. I categorize this as a "plug your nose and buy" rally.

The market is breaking out, buy March calls and sell some February bullish put spreads.

After a big run, the market should be pretty quiet today. Traders will not want to load up ahead of a three-day weekend. As long as Greece keeps its head, the rally should resume next week.

Daily Bulletin Continues...