Use This Tactic To Buy Calls Today – Chance For A Big Overnight Rally – Downside Limited

I highlighted some great trades last night. The options trading webinar was only 30 minutes long.

CLICK HERE TO WATCH THE RECORDING

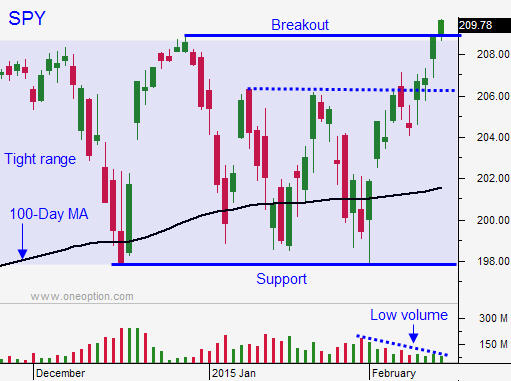

Posted 9:20 AM ET - The market momentum has stalled this week after a big run and a breakout. It doesn't feel like it, but we are making new all-time highs on a daily basis.

As expected, the FOMC minutes were dovish. Stocks tried to rally on the news, but the situation in Greece is keeping a lid on the rally.

Greece submitted an extension request to the EU and the Finance Minister said it should be acceptable to both sides. That leads me to believe that they've made some concessions. The EU will review the request and a response could be coming tomorrow. If Greece gets a six-month loan extension, the market will jump higher Friday.

Option expiration week usually has at least one big day. This is been one of the quietest weeks I can remember. The market is hitting an all-time high and anyone who sold out of the money calls above the all-time high runs the risk of getting squeezed on a big jump.

Last November, the Bank of Japan announced a huge round of QE the night before options expiration. We got a huge gap higher the next day with lots of follow-through. In December, the PBOC made a similar announcement just before options expiration and we got another big move. I don't believe the timing is coincidence. Central banks know that they can get their biggest "bang for the buck" on options expiration.

If Greece does not get a loan extension tomorrow, I don't believe the market will tank on the news. They still have a week (maybe two) to hammer this out. Greek banks are in dire straits as deposits dwindle so there is not a lot of time.

This scenario sets up for and options trades. Since we have a chance for an explosive move higher overnight, I will buy SPY/QQQ call options that expire in March. If Greece gets the loan extension, the market will jump. If they don't, we will tread water and I will be able to get out of my calls without much damage. Dovish comments from the Fed and the possibility of the deal next week will keep buyers engaged. I also have the breakout on my side.

If we get a small dip today, I might even buy some out of the money call options that expire tomorrow. I know this is a lottery ticket so I will keep my size small.

This rally and breakout have come on very light volume. We are not getting any follow-through and that concerns me.

Let's hope for an early low and steady buying the rest of the day. If we can get a nice 10 point S&P rally with a close near the higher the day, I will get a little more aggressive with my call buying.

Look for choppy price action today with the possibility of a big overnight rally.

.

.

Daily Bulletin Continues...