Greek News Is Pending – Market Will Surge Higher On A Loan Extension – Here Is How To Trade It

I highlighted some great trades Wednesday night. The options trading webinar was only 30 minutes long.

CLICK HERE TO WATCH THE RECORDING

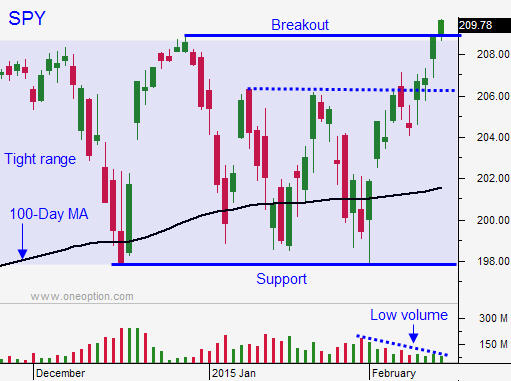

Posted 9:40 AM ET - Last week the market broke out to a new all-time high and this week it has struggled to advance. We need to see follow-through buying in the next day or two or we will drift back into the range.

Options expiration week is typically volatile. In September, October, November and December the market posted strong gains. This is been one of the quietest option expiration weeks I can remember.

Trading volumes are light. Even after dovish FOMC minutes, the market was not able to advance. Perhaps everyone is waiting to hear if Greece gets its loan extension.

A European Summit is meeting and the news will be released shortly. The Greek Finance Minister said that the terms should be acceptable. Most analysts feel that 80% of the work has been done. If Greece gets its extension, the market will shoot higher. If it does not get the extension, we will see a swift and shallow decline.

Chances are that officials will work diligently to work out a deal this weekend if they are close. The loan extension still has to be approved by EU member parliaments and this will take a few days. Greek banks are on the ropes and this needs to happen quickly.

Janet Yellen will testify before Congress next week and her remarks should be dovish. The Fed is worried about the strong dollar and global economic conditions. Fed Speak should keep buyers engaged.

Flash PMI's in Europe were a touch better-than-expected and they were a touch light in Japan. China is celebrating the New Year and their markets are closed. They will post the flash PMI next week (2/25). This number scares me a little because of the weak trade number and it has the potential to disappoint.

Two weeks from now the February jobs report will be released. If it is above 220,000, it will spark tightening fears. We are likely to see nervous trading ahead of the March FOMC meeting.

Look at a chart of the SPY and focus on these dates (9/3, 12/3 and 12/28). In each of those cases, the market rebounded from the 100-day MA and it broke out to a new all-time high. The momentum stalled and the SPY rolled over. If we don't see follow-through buying in the next few days, we run the risk of repeating this pattern.

My market bias gets a little more neutral every day that we sit at this level.

We have a binary event that will hit the market today. If Greece gets the loan extension, I feel that we could shoot higher. The market wanted to rally after dovish FOMC minutes and Greece kept a lid on the move. Out of the money call sellers will scramble to buy their options back and that will fuel the rally.

If the news is good, I will buy out of the money February calls on QQQ 1 strike out. Tech stocks have been strong relative to the market and this index has been moving higher. The options will jump in price, but the move is likely to be bigger than anyone expects given that this is option expiration. This is a very risky strategy since these options expire today. I will also buy some March options.

If Greece does not get its loan extension, the downside will be tested, but the damage will be relatively contained. There is still a bid to the market and most traders feel that a deal will get done.

In conclusion, if Greece gets a loan extension, I will buy calls. If they do not, I will day trade using the ES and NQ futures. I have been trading the short side using ES on the long side using NQ. I want to have relative strength working in my favor and tech stocks have been on a tear.

.

.

Daily Bulletin Continues...