Market Should Grind Higher This Week – Greece Gets the Loan and Yellen Is Dovish

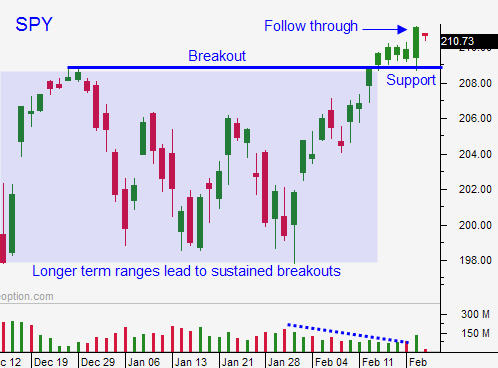

Today's options trading strategy - I will buy call options on stocks that are breaking through horizontal resistance. I favor this strategy because we have a market breakout and follow through. As long as the SPY stays above $209, I am comfortable holding call options. I want to see these stocks continue to move higher. If the momentum stalls, I will exit and look for another breakout.

Last week the market remained quiet as traders waited for the Greek loan extension. That news hit late Friday afternoon and stocks rallied on the news. We have the follow-through we were looking for and the price action should be bullish this week.

The EU granted Greece a loan extension for four months and this will remove fear for at least a month. The rhetoric will escalate in coming weeks and this dark cloud will hang over the market the entire year. EU members will be divided on Greexit, but I believe Greece will eventually force their hand.

EU governments hold about 62% of Greece's debt and 18% of it is held by the ECB/IMF. Bank exposure is relatively limited and if Greece is kicked out, the risk should be contained.

Last week the FOMC minutes revealed that the Fed is still dovish. Janet Yellen will testify before Congress this week and her remarks should be market friendly.

The next jobs report is 11 days away and that gives us some breathing room. A strong number above 220K would raise tightening fears.

The economic releases are fairly light this week and durable goods/GDP will not move the needle. Both numbers missed expectations a month ago.

China's flash PMI has the potential to disappoint. This number scares me a little, but a miss won't have any lasting effect on the market. Traders will expect additional easing by the PBOC.

Earnings season is winding down and the results have been good.

In the event that SPY $209 fails, we could see some nasty selling. Bullish sentiment is very high and these traders will quickly get flushed out.

Look for early weakness today. The market will probe for support and the bid should strengthen. I believe the market will recover these early losses and the price action the rest of the week should be positive.

.

.

Daily Bulletin Continues...