Market Will Grind Higher – Yellen Will Be Balanced – China’s Flash PMI Could Be Weak

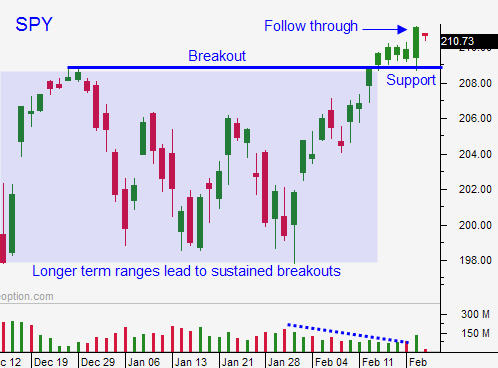

Options Trading Strategy - I bought call options on stocks that are breaking through horizontal resistance. I'm using that breakout as my stop. I did not sell any bullish put spreads. Option premiums are cheap and I will get my biggest bang for my buck buying call options. This rally needs to follow through and as long as we are above SPY $209, I will stick with this options trading strategy. I know that I might have to weather a one-day decline so I am keeping my size relatively small. I would prefer to buy a dip, but we might not get one.

Posted 10:30 AM ET - Last week the FOMC minutes were dovish and Greece got a four-month loan extension. The market has all of the news it needs to grind higher. This breakout needs to gain traction or we risk falling back into the trading range.

Janet Yellen will testify before Congress this morning and her statements will be balanced. We know that she is dovish and the Fed favors gradual tightening later this year. Strong employment statistics will be offset by global economic concerns. A strong dollar will hurt exports and the Fed does not want to fuel that rally.

China will release its flash PMI tomorrow and this number has the potential to disappoint. Their trade numbers were very weak. If we get a big miss, the market could have a nasty one day decline. Bullish sentiment is very high and speculators need to get flushed out. We could test the breakout (SPY $209) if this happens. The damage will be contained since traders will expect easing by the PBOC.

Earnings season is winding down and the results have been good.

Durable goods orders and GDP missed estimates last month, but I don't believe either number will move the needle. Major economic releases are more than a week away. The jobs report could be another speed bump. If employment grows by more than 250,000, tightening fears will escalate. We could see nervous trading into the March FOMC statement if this plays out.

The market has been in a three-month range and that means this breakout could have legs. The path of least resistance is higher.

Every day that the market ticks higher, under-allocated Asset Managers get more nervous.

Look for choppy price action with an upward bias. Janet Yellen's statements should be market friendly.

.

.

Daily Bulletin Continues...