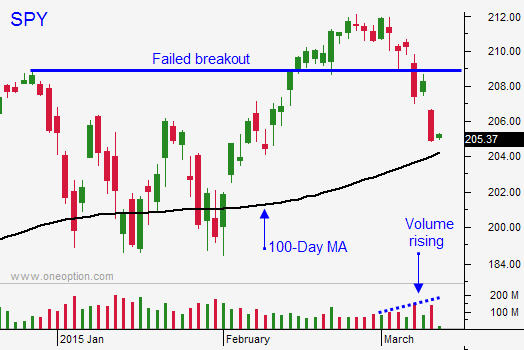

Market Decline Will Continue – Hold On To Your Put Options – SPY $204 Will Be Tested This Week

Posted 9:45 AM ET - Yesterday we saw heavy selling. The market will test the 100-day moving average this week. Traders are nervous about next week's FOMC statement and the pressure will continue.

In my comments I've been mentioning a pattern that we've seen the last six months. The SPY declines to the 100-day moving average and then it rebounds sharply to a new all-time high. The distance between the previous high and the new high is small (bearish). The market rally stalls and the breakout fails. Bullish speculators are flushed out and the cycle repeats.

During the last rally, the volume was light. Once the momentum stalled I knew we were in trouble. I started buying puts when SPY $209 was breached. I added Monday and Tuesday and I have reached my target allocation (35%). I am not as aggressive on the market declines because we are still in a five-year bull market. As long as major moving averages hold, I won't increase my bearish allocation. If we start closing below the 200-day moving average, I will start to ramp up my bearish allocation. That hasn't happened yet and every decline needs to be treated as a buying opportunity.

I preach buying breakouts - especially when there is horizontal resistance. These moves tend to be sustained and sometimes the breakout leads to the next big rally. When these breakouts fail, it also presents an opportunity. Bullish speculators piled in on the breakout and when that move fails, they all hit the panic button at the same time. The backside can be very nasty and this pattern works for stocks and ETF's. Look for failed breakouts/breakdowns if you like trading reversals.

The news from China was disappointing. Retail sales came in at 10.7% when 11.6% was expected. Industrial production came in at 6.8% versus 7.7% expected. As you know from my comments, China is my greatest concern this year.

Yesterday I outlined issues in Russia, Greece and oil dependent emerging markets. These credit issues will plague the market.

The dollar is almost at par with the euro and this will impact corporate profits and exports.

We've seen very heavy selling the last few days and the market will probably rest today. We will see an early bounce and it will stall. Sometime this morning, the downside will be tested. I believe the damage will be relatively contained today. Global markets are holding up well. If by chance we make a new low after a few hours of trading, we are likely to test the 100-day moving average. I believe that support will hold today if this scenario unfolds.

By the end of the week, I am expecting the 100-day moving average to be challenged. Some traders will reduce risk into the FOMC statement and many are likely to sell before the weekend.

I am in profit management mode at this stage. This is been an excellent trade and my put options are also benefiting from an increase in implied volatilities. I am lowering my stop to SPY $207 on a closing basis. That gives me plenty of breathing room. I want to hang onto my put positions as long as I can and I expect to see additional weakness before next Wednesday. I am trading against a five-year bull market and I know that I'll probably have to weather a few rallies.

Stay short.

.

.

Daily Bulletin Continues...