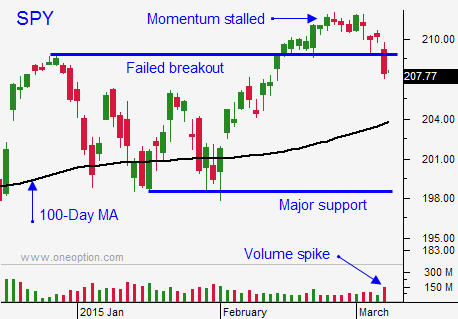

Market Breakout Failed – We Are Going To Test SPY $204 Very Soon – Buy Puts On Any Rally

Options Trading Strategy - I am long put options and I will add to my position today. I'll be looking for a bounce in the first couple of hours of trading. When that move exhausts itself, I will buy more put options. I believe that we could test the 200-Day MA after the FOMC statement next Wednesday. They are likely to remove the word "patient" and the market won't like it. I have a 25% allocation now and I will take it to 35% by the end of the day.

Posted 9:45 AM ET - Yesterday, the market bounced after a heavy selloff on Friday. Apple released new products and that kept buyers engaged. The SPY closed below $209 and we were able to maintain our short positions. This morning, stocks are weak and the S&P futures will take out Friday's low ($207.10).

In my comments I mentioned that we are likely to challenge the 100-day moving average this week. The news is light and that favors bears. Bullish sentiment was extremely high and speculators are getting flushed out.

Tomorrow, China will post retail sales and industrial production. Every time they post a number, I hold my breath. I still feel slowing activity in the world's number one economy is the greatest threat to this rally. Manpower (a job placement company) said that employment conditions in China have not been this weak since the financial crisis.

Speaking of jobs, I believe our Unemployment Report was a joke. It was contrary to every other employment report (initial jobless claims, ADP and Challenger). At 10:00 AM ET we will get the JOLT report. It measures job openings. I don't typically pay much attention to the number, but 21 states have increased the minimum wage. More than a quarter of our job growth has come from low-paying jobs in the service industry. When wages increase, employers hire fewer workers and they find ways to increase productivity.

I'm not concerned about the Fed raising interest rates. They are all dovish and any move will be gradual. They know global economic conditions are soft and that this is an issue.

Greece will be on the ropes until they crash. There will be constant twists and turns and default will constantly be in play. The EU extension was simply a PR move to keep deposits from flying out of banks. They are currently in a cash crunch and they could run out in a matter of weeks.

Oil prices continue to slump. This is going to affect emerging market credit. Russian corporations are asking Moscow for bailouts to the tune of $37 billion. Putin doesn't have the money and this problem will only get worse.

I've grown more bearish than I've been in years and have been very vocal about it. The price action the last five months has been dismal. That does not mean that I am going to load up on puts. We are still trading against a five-year bull market and this rally will die hard. I won't get aggressive until I see us close below the 200-day moving average consistently. Until then, every pullback has to be treated as a buying opportunity (once support is established).

The strong dollar is wreaking havoc on hedge funds, banks and international companies. Massive currency adjustments are taking place and this is another uncertainty that is plaguing the market.

Stay short and buy more put options.

.

.

Daily Bulletin Continues...