Market Bounce Sparked By Central Bank Easing – Lower Your Stops – Watch the Close

Posted 10:40 AM ET - Yesterday, the market took a breather. That was expected after a couple of days of heavy selling. Tech stocks took a beating late in the day and overnight news from Intel will keep pressure on the sector. The S&P 500 is up 17 points this morning on central bank easing.

Overnight, South Korea "surprised" the market with a .25% interest rate cut. Is any central bank easing really a surprise that the stage?

I've been mentioning in my comments that it will be tough to be short. When you are trading against a five-year trend, you can expect to take heat along the way.

It's not the open that concerns me, it's the close. We did see weakness in the tech sector late yesterday.

Traders are still worried about the FOMC meeting next week. I believe they will remove the word "patient", but they will find a way to soften the blow. They know that February's jobs number was a joke and that a strong dollar will take its toll on corporate profits and exports. The Fed does not want the dollar to spike more than it already has.

Retail sales came in at -.6%. That was weaker than expected. All of our economic releases have been shy of expectations in the last couple of months.

Credit concerns in Greece and Russia are real.

China’s economy continues to slip and their retail sales and IP were weak.

Asset Managers are more interested in overseas markets where they have central bank support. Money will rotate into Europe and Asia and the bid to the US market will remain soft until the FOMC statement.

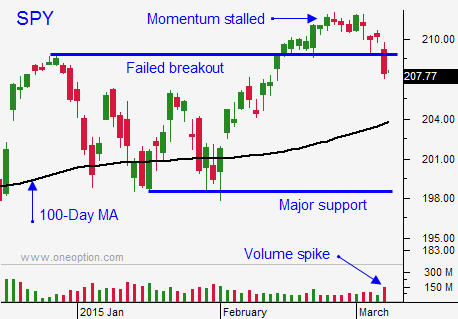

I am long puts and I am lowering my stop to SPY $206 on a closing basis. I don't want to stop out until I see the close. On an intraday basis, I will stop out if we rally above SPY $207. That will mean that this rally is gaining traction and I don't want to stand in the way. Even at that level, I will still lock-in nice profits.

Try to maintain your put positions. There is a good chance that once this rally exhausts itself, it will roll over. A reversal would be very bearish.

These swift declines tend to run their course quickly and I'm looking for follow-through selling today and tomorrow. I don't get it; I want to be on the sidelines.

.

.

Daily Bulletin Continues...