FOMC Could Push the Market To the Edge – Free Webinar Tonight

I will be hosting a webinar Wed night and I will introduce a new pricing model for our trade signals. Pick your own symbols and pay one low quarterly price per symbol.

CLICK HERE TO REGISTER

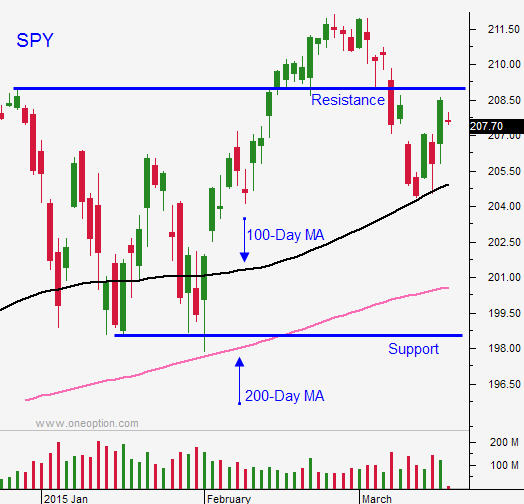

Posted 10:00 AM ET - The market has drifted right back into the middle of its 6 month trading range. Traders are waiting for the FOMC statement this afternoon and the action will be dull ahead of the release.

Since August, the S&P 500 has rallied 3%. The five-year bull market is tired. Asset Managers are not aggressive, but they will buy dips. When the market rallies to the all-time high it barely pokes through before profit-taking sets in.

Interest rates are at historic lows and money continues to flow into equities due to a lack of attractive investment alternatives. Corporations are also buying back shares at a record pace and that is keeping a bid to the market.

Global economic activity is strained and central bank money printing has not stimulated growth. Sovereign debt levels are extremely high and credit risks could emerge and any time. Consequently, we see natural selling every time the market tries to breakout.

Option implied volatilities indicate that at 2% move is expected by the end of the week. That would keep us in the current trading range.

The Fed will substitute the word "patient" for some other adjective. They do not want to fuel the dollar rally and they will find a way to soften the blow.

I will trade the release once the dust settles. It usually takes about 15 minutes for the direction to be established. Quadruple witching has the potential to fuel the move, but this could be a very boring (balanced) release with no surprises.

From a swing trading perspective, the better move will come when the market reaches one extreme or the other. I believe this trading range will hold and once the move loses its momentum, we will reverse.

The middle of the trading range is not where we want to be. Let's hope for a move to one extreme or the other.

.

.

Daily Bulletin Continues...