The FOMC Reaction Will Present A Trading Opportunity – Market Could Go Either Way

I will be hosting a webinar Wed night and I will introduce a new pricing model for our trade signals. You can pick you own symbols and pay one low quarterly price per symbol.

CLICK HERE TO REGISTER

Posted 10:00 AM ET - In the last eight hours of trading buyers have decided that the Fed won't tighten until September and the S&P 500 has rallied 40 points. Most expect the word "patient" to be removed from the FOMC statement tomorrow and that Yellen will find a way to soften the blow. Good news is priced in and the market has had a tendency to rally into the FOMC statement.

In my comments I've been pointing out that economic conditions have been soft and that the jobs report ran contrary to every other release. I don't trust the government's number and it will be revised.

Tightening does not scare me. It would be a sign that economic conditions are improving and that the training wheels can finally come off. Unfortunately, growth is fragile and the Fed knows it.

Central banks have thrown trillions of dollars into QE and it is not stimulating economic activity. This is a much greater concern. If conditions continue to deteriorate globally, there is not much more that can be done. As economies contract, credit issues will arise.

China's Finance Minister said that they will be hard-pressed to hit their 7% growth target. This is the largest economy in the world and after decades of hyper-growth, they have excess capacity.

Money printing has pushed yields down to historic lows. This in turn has pushed investors out on the risk curve - equities are attractive relative to bonds. Asset Managers have to put their money somewhere and that is why we are near all-time highs.

Corporations have opted to buy back shares rather than to invest in plant and equipment. They have plenty of excess capacity and growth opportunities are limited because consumption remains constrained. Repurchases are at record levels and this has also contributed to the rally.

The SPY has only moved 3% higher since August and this five-year run is tired. I believe that a correction (10%) lies ahead. We don't have to worry about a crash until credit concerns escalate and I don't see that happening this year. China will be the key.

I am currently in cash. Traders will square up positions today and the action will be choppy within a defined range.

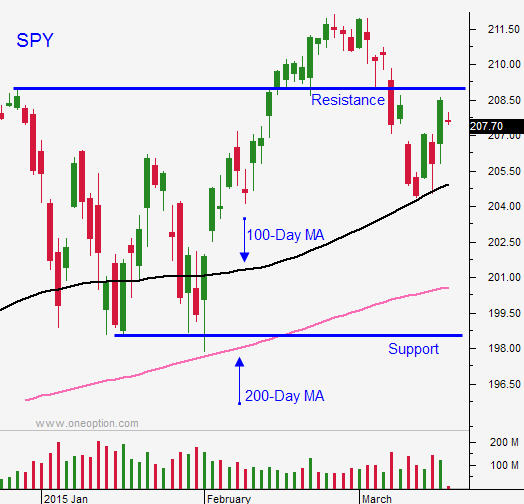

Once the FOMC statement is released, we should see some action. I will wait for the dust to settle (15 minutes) and once we have established a direction, I will trade in that direction. We are right the middle of the range (SPY $199 - $212) and the market could swing either way. Quadruple witching will fuel the move.

I won't stick with this trade too long. The move one way or the other will push us to the edge of the range and the reversal will be the better move. If we rally to the all-time high, a selling opportunity will present itself. If we fall to the 200-day moving average, a buying opportunity will present itself. Support and resistance is strong at the extremes.

Keep your trading small until the FOMC statement.

.

.

Daily Bulletin Continues...