FOMC and Quad Witching Will Spark A Move Today – Use the First Hour Range As Your Guide

Last night I introduced my new website and pricing model during a webinar. You can sign up for individual symbols for just $20 per symbol per quarter. You'll find the video embedded at the bottom of this blog post.

Posted 10:20 AM ET - Yesterday, the Fed removed the word "patient" from its statement and this was widely anticipated. They now have the latitude to raise rates at any time, but they are unlikely to. They are concerned that economic conditions are fragile and they don't want to add to fuel to the dollar rally.

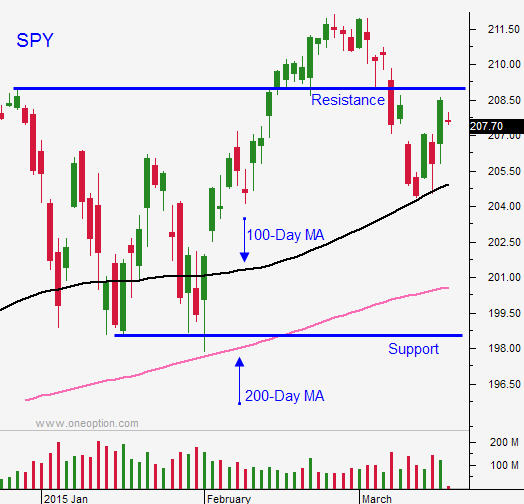

The market rallied on the news, but it was not able to take out the all-time high. During the last hour of trading the S&P 500 retraced 10 points and we are seeing follow-through selling this morning. Quadruple witching could have goosed the market, but resistance was too strong.

I seriously question the strength of the market. When a quarter-point rate hike from 0% to .25% spooks investors, it is a bearish sign.

Economic data points have been deteriorating the last two months (with the exception of the jobs report). Personally, I feel the government's number is a farce. It is filled with seasonal adjustments and workers keep getting stripped out from the labor force (this makes the unemployment rate look better than it is).

Global economic conditions are deteriorating and central bank money printing is not stimulating activity. This is the real issue. With interest rates already at 0% (in some cases negative territory), this artificial support has reached its limits. Now economies will be forced to go through a natural economic cycle.

The market was not able to rally on good news. If all that matters is interest rates, we should be making a new all-time high today. Central banks (Japan, Korea, China, the ECB and India) have recently eased and the reaction has been muted.

On the opposite side of the ledger, there are plenty of things that can go wrong (Russian credit, Greece, economic data, wage inflation and earnings warnings). Consequently, I am more bearish than bullish.

I was hoping for a rally that pushed us to a new all-time high. That move would have exhausted buyers and we would've seen a nice reversal. If the market rolls over now, we will take out the 100-day moving average.

I will monitor the one hour range. If we are above it, I will day trade from the long side and use that high as my stop. If the market falls below the one hour low, I will day trade from the short side. If the SPY trades below $209, I will also buy puts for an overnight position.

Look for choppy trading during the first hour. The market should set a direction after that and the momentum should continue the rest of the day. The FOMC statement and quad witching will push us one way or the other today and I am expecting good movement.

.

.

Daily Bulletin Continues...