Market Excited – Jobs Not That Good – Resistance Should Hold

I have been searching for new trades and I just updated my list. CLICK HERE TO TAKE THE FREE TRIAL. You will have access to my trades and an exclusive chat room.

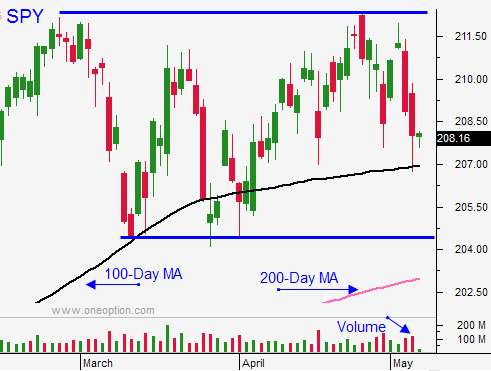

Posted 10:30 AN ET - This is the definition of compression. Prices are wound so tightly that the S&P 500 has gone from the all-time high down to the 100-day moving average and back to the all-time high all in the span of one week. The moves are erratic and at best we only get follow-through for one day.

The Unemployment Report came in at 223,000. That was the sweet spot and the S&P 500 rallied 25 points on the news. This move feels like short covering.

The number was not that impressive. We need more than 300,000 new jobs just to keep up with labor force growth.

Today we will be able to gauge the appetite for stocks at the all-time high. My suspicion is that Asset Managers are not going to chase equities at a rich forward P/E of 18. We will challenge the high and eventually drift lower.

You know from my comments that I wiped the slate clean on Wednesday. I took profits on my put positions when we hit my target (100-Day MA). I had May options and time decay was becoming an issue. I knew that I could not weather another snapback rally, so I took profits. I also did not trust this herky-jerky market.

Yesterday, the market rallied in the first hour and it flat lined the rest of the day. There was nothing to trade ahead of the number.

I can't embrace this rally. We are at the top of the trading range and I don't see a catalyst that will push us through. I suspect that bulls will try to force a breakout today and after a few days, the market will get tired and test the downside.

If by chance the market breaks out, it will have to close above the all-time high for a few days before I will consider getting long.

Let's see what happens. I would love to see a breakout because it will get us out of this trading range.

If resistance proves to be too strong, I will start shorting next week.

The early momentum tells me that we probably won't see a big reversal today. We are 30 minutes into trading and we would have seen weakness by now. Chances are we will rally and settle in for the rest of the day near the all-time high.

I will looks for day trading opportunities from the short side today.

.

.

Daily Bulletin Continues...