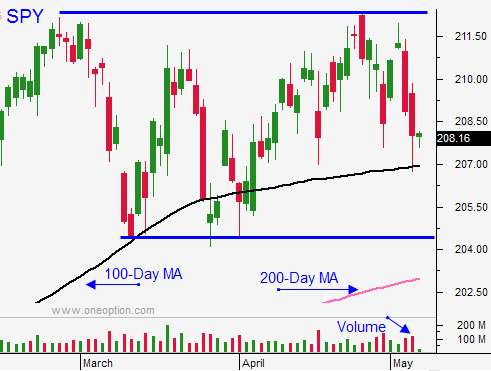

Market Will Re-Test the 100-Day MA – Support Will Hold Ahead of Jobs Report

I have been searching for new trades and I just updated my list. CLICK HERE TO TAKE THE FREE TRIAL. You will have access to my trades and an exclusive chat room.

Posted 9:45 AM ET - Yesterday, stocks continued to decline and we saw follow-through selling. If you've been reading my daily comments, you know I've been patiently waiting for this opportunity since the start of earnings season. Mega cap tech stocks are out-of-the-way, the market is trading at the upper end of the range and stocks are rich at a forward P/E of 18. The S&P 500 touched the 100-Day MA Wednesday and it bounced.

The S&P 500 was down to the 100-Day MA before the open and I suspect we will test it today. I will be looking for shorting opportunities right from the opening bell.

I bought puts last week and my profits quickly turned to losses during Friday's rally. Fortunately, I had the fortitude to stick with my positions. I mentioned last week that my trading system had sell signals on 75% of the stocks in the S&P 500. This was at a time when the market was making a new all-time high.

My put positions where at breakeven Tuesday and they went in the black yesterday. I took profits when my target was reached SPY $206.80. May option expiration is approaching and time decay is a factor. I could not weather another snapback rally and it was wise to take profits in this directionless market. With a clean slate, I can reevaluate.

I day traded S&P futures from the short side yesterday and I bought SPY put options. I also took profits on those trades.

The market is likely to test the 100-day moving average today. However, with a major announcement tomorrow, I believe that support level will hold. Traders will wait for the number.

Analysts are expecting 218,000 new jobs. If we come in below 180,000 or above 250,000, I believe the reaction will be negative. Anything in between should be market friendly. The Unemployment Report has typically been better than the ADP report and I believe bad news is priced in.

Either way, I still believe the market will eventually head lower. If stocks tank on the news, I will wait for an opportunity to get short. In that scenario the 100-day moving average will have been breached with ease and we are likely to test the lower end of the range. If the reaction is positive, it might be a sign that buyers are still engaged and we have to let that wave of buying run its course before we reload.

I will be day trading from the short side today, but I plan to be flat overnight. If you are long puts take profits on stocks that are starting to lose their downward momentum. If you want to keep a few shorts on, focus on stocks that have broken technical support and that have steady selling pressure.

The market has been in a seven month range. Until we breakout or breakdown, we have to assume that every move is nothing more than noise. It is a hit and run environment. When we do breakout of the range, we are likely to trend and then we will have plenty of trades.

Ride your put trades today and take profits.

.

.

Daily Bulletin Continues...