Resistance Will Hold – Shorting Opportunity Ahead – Be Patient

I have been searching for new trades and I just updated my list. CLICK HERE TO TAKE THE FREE TRIAL. You will have access to my trades and an exclusive chat room.

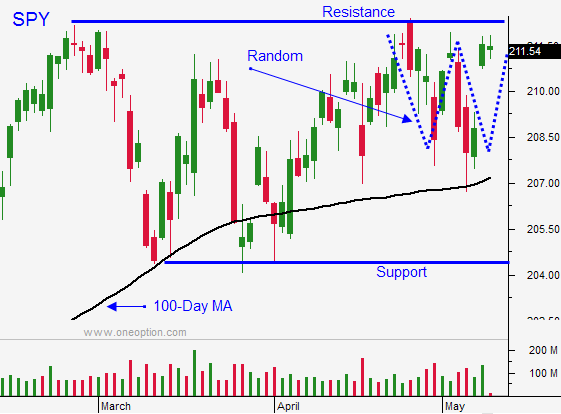

Posted 10:30 AM ET - Last week, the market started at the all-time high, it pulled back to the 100-day moving average and it finished the week at the all-time high. This might sound like extreme price moment, but it was not unusual. Prices are compressing and we are close to major support and resistance.

Buyers and sellers are paired off. The market lacks a catalyst and we are in a choppy "hit and run" environment.

The PBOC cut interest rates by .25% over the weekend. This is the third rate cut this year and it signals weakness ahead. China is trying to stay ahead of deteriorating conditions.

The market doesn't care about economic activity. It is only focused on money printing.

Last week's jobs report sparked a huge rally. In April, 223,000 new jobs were created. We need over 300,000 jobs just to keep up with the growing labor force. March was lowered by 35,000 and this was not a strong employment report. Traders rejoiced on the notion that the Fed will not raise rates until September.

The news is light this week and I fear that prices will compress even further. The FOMC does not meet for another month, major economic releases are behind us, earnings season is winding down and a major holiday is approaching.

I am selling out of the money put credit spreads to distance myself from the action. Stocks will try to breakout, but when this rally stalls, there might be a nice shorting opportunity at the top of the range. I'm not looking for a big move and my put credit spreads should remain out of harm's way.

Retailers will be posting results this week. Traders are expecting good results and when they don't materialize, they will blame it on bad weather. I believe there are greater forces at work.

Every month we hear about low inflation and a "tax holiday" due to lower gasoline prices. I'm sick of hearing this and I believe that inflation is killing consumption.

A loaf of bread might cost as much as it did a year ago, but look at the big-ticket items. College tuitions are increasing 10% annually and baby boomers are helping their kids so that they don't have to start life $150,000 in the hole.

Health insurance premiums are skyrocketing. Mine increase 10 to 15% every year and this year I'm paying $3000 more (my family of 5 is healthy). Most employers will cover half of this expense, but that is still $1500 less disposable income per household. Many people are opting for higher deductibles so that they can afford premiums. Hopefully, they don't get sick.

In Rockford Illinois the property taxes on my mom’s 2 bedroom condo went up 80% in 2014. Chicago property taxes are slated to go up 50%. Expenses are increasing by thousands of dollars every year and no one talks about this.

Interest rates are at 0% and money printing has not stimulated economic growth. GDP came in at .2%. Analysts cite bad weather and they expect an economic rebound due to pent-up demand (even though we didn't get one after the polar vortex in 2014).

The market is treading water for one reason. Investors/corporations have very few investment alternatives. With interest rates are at historic lows, investors are being pushed out on the risk curve and they are buying equities. Corporations are not investing in plant and equipment. They have access capacity and they don't see a sustainable uptick in demand. Consequently, corporations are buying back shares at record levels (twice the rate in 2014).

Consumption is soft, economic growth is sluggish and stocks are trading at a rich forward P/E of 18. Stocks are trading at the upper end of the range and I believe there will be a shorting opportunity. It will be brief, just like the decline last week.

I am selling out of the money put spreads on strong stocks so that I can distance myself from the action. I will watch for signs of exhaustion. If I see late day selling, I will buy some puts.

Activity could dry up. This is a low probability trading environment so keep your size small.

.

.

Daily Bulletin Continues...