Market Friendly Econ Numbers Will Off-Set Nervousness In Europe

Posted 9:45 AM ET - Yesterday's gains are being stripped away this morning. I hate to sound like a broken record, but this price action is nothing but noise.

ISM manufacturing came in a little better than expected yesterday and it took the sting out of dismal numbers last week (GDP and durable goods). ISM services should be decent tomorrow and ADP will be in line. The news will be good enough to support the market, but not strong enough to spark a breakout.

The ECB will post its rate decision tomorrow. They have been more hawkish recently and a strong core CPI number (.3%) will keep them on that path. This is the first sign of inflation in Europe in six months. Greece is trying to secure major financing over the next month and negotiations are tenuous. Consequently, the ECB will tone down the hawkish rhetoric tomorrow.

European economic activity has improved, but demand is not pushing consumer prices higher. Most of this increase is due to currency devaluation. The Eurodollar has been smashed and it costs more to import goods.

Last month, 223,000 jobs were created and the market rejoiced. This is a lukewarm number and we could see a similar reaction Friday.

Greece is the "fly in the ointment". It has the potential to spark a decline in the next month. They have many hoops of fire to jump through the summer. If they get this tranche of financing, the market will settle in to the summer doldrums.

The next big news event is on June 17th. The Fed is not likely to raise rates until September (at earliest).

I am short June bullish put spreads and those positions have almost maxed out. I will be buying those spreads back this week to release margin and to lock in profits. I am constantly looking for bullish put spreads to sell. I prefer stocks that have pulled back and have formed a base.

I am also buying low-priced stocks that are breaking through horizontal resistance.

This strategy has yielded excellent profits. These stocks have strong bid and the pattern produces sustained rallies. When the market pulls back, buyers are lined up and the stocks tread water (my downside risk is contained). If the breakout fails, I exit the trade. If the momentum stalls, I take profits. Since I'm buying the stock, I don't have to worry about time decay or option liquidity.

These are swing trades and plan to hold the stock overnight. Sometimes the move takes a day or two to get going in sometimes the stocks take off right away. The price action is stable and they are unaffected by the day-to-day wiggles and jiggles in the market. I suggest trying this strategy – I like stocks that are under $25. We could be in a tight trading range this summer.

The Greek loan agreement is like our debt ceiling negotiations. Politicians will wait to the last second and the market will get nervous. Ultimately, the deal will get done.

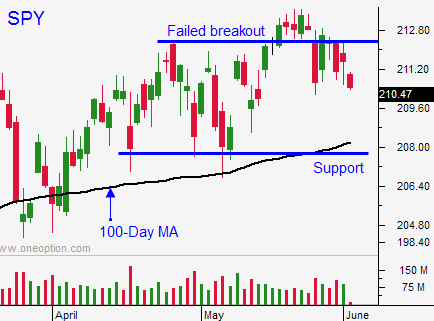

Market friendly economic releases will offset nervousness in Europe. Look for choppy price action this week. I am expecting SPY $208 to hold. That is horizontal support and it is the 100-day moving average.

Keep it small. Sell put premium when possible and buy some cheap stocks that are breaking out.

.

.

Daily Bulletin Continues...