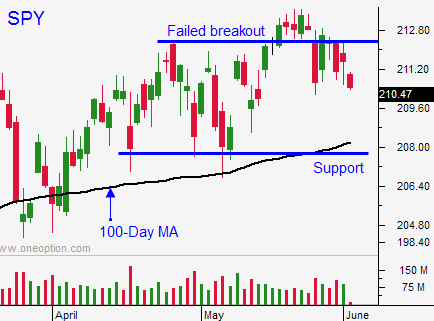

Market Pricing In A Greek Deal – Goldilocks Jobs Number – Resistance Strong At SPY $212

CLICK HERE TO TAKE THE FREE TRIAL. You will see today's trades it in the chat room and you will see the stocks in Pete's List.

Posted 9:40 AM ET - Yesterday, the market tried to rally through resistance at SPY $212, but it was not able to hold that level into the close. That could change this morning and we have a nice pre-open rally.

ADP came in at 201,000. That was spot on and it bodes well for Friday's jobs report. The service sector had many new hires and that could be a good omen for ISM services (30 minutes after the open).

The ECB left rates unchanged as expected. Mario Draghi's statements have not generated much of a reaction. EU GDP forecasts for 2015 have been raised to a whopping .3%.

Traders are pricing in a Greek deal Friday. European officials have drafted a final proposal and it will be a "take it or leave it" situation. This is the first of many big loans that Greece needs to secure in the next month and the EU is done playing cat and mouse.

If the deal gets done, the market will rally. There is a chance that Greece will "play chicken".

I sold out of the money bullish put spreads for June expiration a few weeks ago. Those trades have almost maxed out and I will be buying them back Thursday. This will allow me to reduce risk and to release margin. I did sell a couple of July put spreads yesterday. These stocks have been badly beaten down and a base has formed. I am selling these put spreads below support. If that level is breached, I will buy the spreads back.

I have also been buying low-priced stocks (under $25) with excellent success. These stocks have consolidated in a tight range and they are breaking through horizontal resistance on heavy volume. If they are on a buy signal from my trading system, the probability of success is extremely high and I'm making over 5% (unleveraged) in a matter days. If you want to see some of the stocks, take the Free Trial. They are in Pete's List and we are discussing them in the chat room.

The Beige Book won't generate much of a reaction this afternoon.

If the major news events this week don't spark a move one way or the other, we will fall into the summer doldrums. The next big news event is on June 17th (FOMC Meeting).

This is a low probability trading environment and the strategies I've outlined are generating profit while keeping my risk relatively low.

Look for an upward bias today. A close above SPY $212 would be constructive.

.

.

Daily Bulletin Continues...