Big News This Week – No Lasting Impact – Summer Doldrums Ahead

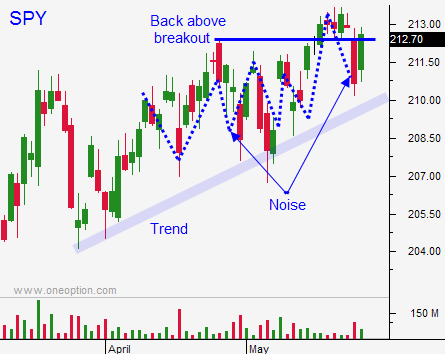

Posted 11:20 AM ET - Last week the S&P 500 chopped back and forth. This is a directionless market and major news events are scheduled.

ISM manufacturing was better than expected and it came in at 52.8. That might take some of the sting out of last week's dismal GDP (-.7%) and durable goods (-.5%) numbers.

ISM services will be posted Wednesday along with ADP. I am expecting Goldilocks results (not too hot, not too cold). The ECB will also post its rate decision. They have been more hawkish recently, but I'm not expecting a negative tone ahead of a Greek decision.

Greece has to secure major financing Friday. This is the first in a series of major loans in the next month and conditions are fragile. Rumor has it they almost missed an IMF payment last month. Grexit is a distinct possibility and this is the only event that could push us out of the trading range this summer.

Analysts are projecting 225,000 new jobs when the Unemployment Report is posted Friday. The results should be in line with expectations and the market had a positive reaction last month.

The only other market driving event is a potential rate hike. The Fed will release its statement on June 17th and they are not likely to take action until September (or later).

I fear that the news events this week will not generate much of a reaction and that Greece will secure its loan. If this happens, we will fall into the summer doldrums.

The rest of the summer, we will be on "pins and needles". Every news event from Greece and every word spoken by Fed officials will be scrutinized. Stocks will chop back and forth and we won't see any sustained directional moves.

Global economic conditions are frail and stocks are trading at a forward P/E of 18. Bond yields are at historic lows and equities are the best game in town. These opposing forces are keeping the market in its range and apart from Grexit or a Fed rate hike; I don't see anything that will spark a breakout.

Option implied volatilities are getting crushed and my bullish put spreads are in fantastic shape. I am ready to take profits this week. If the market declines to the 100-day moving average (SPY $208), I will sell July bullish put spreads. The opportunity will be brief and I won't waste any time. If I don't get the pullback, I will stick to my other strategy. I have been trading low-priced stocks with excellent success.

I am buying stocks that are trading below $30. I need to see consolidation, a breakout above horizontal resistance, strong volume, follow-through and a buy signal for my trading system. If I have all of these ingredients, the probability of success is very high. I don't have to worry about the market since these stocks have momentum and a strong bid. If the breakout fails, I exit the position. When the momentum stalls, I take profits. Since I am trading the underlying stock, I don't have to worry about time decay. If I want to leverage this strategy, I can buy the stock on margin. I will do this if I close out my bullish put spreads and release margin.

I am focusing on strong stocks and I know I don't have a market tailwind helping me out.

I hate to splash cold water on the news filled week, but I don't see anything that will materially change the trading landscape.

Follow these guidelines and you will be able to make some decent money during this holding pattern.

.

.

Daily Bulletin Continues...