Reduce Risk Today! Nasty Decline More Likely Than A Breakout

CLICK HERE TO TAKE THE FREE TRIAL. You will see today's trades it in the chat room and you will see the stocks I am trading in Pete's List.

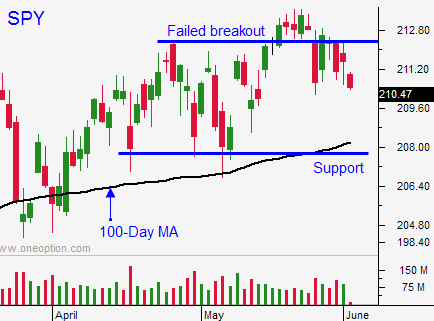

Posted 9:50 AM ET - Yesterday, the market rallied above SPY $212 on a solid ADP report and a good ISM services number. I mentioned early in the week that strong economic news would offset Greek worries. This morning, the market is back below SPY $212 and we continue to chop back and forth.

I do not feel like I will miss the next big rally. The market has tried to breakout since February and it has not been able to. Resistance is strong.

In the last week, buyers have tried to push stocks through and every time we rally above SPY $212, we fall back below it the next day.

I fear that most traders feel the same way I do. I've had an excellent month and my plan all along was to reduce risk into Friday. This could be creating the selling pressure this morning. Asset Managers will not chase stocks at an all-time high and they will pull their bids if the selling momentum gains traction. Bullish speculators will get flushed out and we will hit an air pocket.

I sense that if I overstay my welcome, the rug will get pulled out from under me. I am buying back my June put spreads and I am locking in profits today. I am also exiting some of my low-priced stock positions. I do have July bullish put spreads, but I don't have many positions established yet. I will hedge using the S&P futures if I need to, but my exposure is very small.

If it sounds like I'm bearish, I'm not. I just feel that a decline is very possible.

The jobs number should be market friendly.

Greece needs to secure financing tomorrow. Their leader said that the IMF will get paid and the market is pricing in a deal. Greece will need to cut benefits and increase taxes. This will not sit well with the people and the next round of financing could be strained. Greece will have to go through this process many times in the next month and this could come to a head.

The market is in a news vacuum. It is searching for any headline and a surprise from Greece could spark major selling.

Why take the risk? Lock in profits and go to cash. We already know that the market can't get through resistance so let's wait and see how all of this plays out.

In two weeks, the FOMC will meet. No one is expecting a rate hike in June, but if the rhetoric suggests a September timeline, bonds will fall. We've are seeing weakness in global bond markets.

Stocks in China have been very toppy. They sold off 6% last week and bounced. Last night they fell 5% and bounced. Brokerage firms are increasing margin requirements and any market decline could have a cascading effect. The price action is toppy.

When you add all of these factors up, it doesn't make sense to have a lot of market exposure. Evaluate your positions and reduce risk - NOW.

I still consider this a low probability trading environment. Look for choppy trading and the potential for a nasty decline today.

.

.

Daily Bulletin Continues...