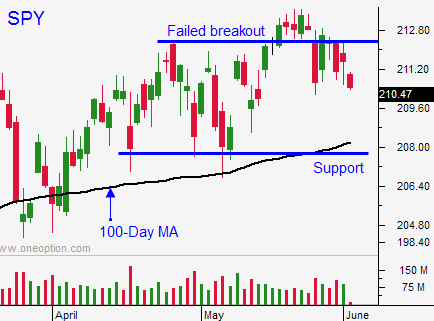

Market Will Test the 100-Day MA – More Selling To Come the Next 2 Weeks

CLICK HERE TO TAKE THE FREE TRIAL. You will see today's trades it in the chat room and you will see the stocks I am trading in Pete's List.

Posted 9:50 AM ET - Yesterday, I warned you that the table was set for a pullback. The market had been trying to break through resistance for a couple of weeks to no avail. Traders reduced risk Thursday and once the selling momentum was established, Asset Managers pulled bids. Bullish speculators got flushed out and we hit an air pocket. I will be looking for shorting opportunities today.

The Unemployment Report exceeded expectations today. We learned that 280,000 new jobs were created in May and analysts were expecting 220,000 new jobs. This is going to put a Fed rate hike in play and it is short-term bearish for the market.

The FOMC meets on June 17th and traders will be on high alert. No one is expecting a rate hike in June, but they will be looking for any language that sets the timetable for September.

Greece "kicked the can" and they bought themselves a couple of weeks. They bundled IMF payments and postponed them until the end of the month. Greece only has a couple of weeks to reach an agreement and the stakes are high. Creditors and Greek officials leaked their proposals and there is still a huge gap that needs to be filled.

The news will dry up next week and if we don't get some movement today, we will fall into the summer doldrums. I will be day trading from the short side.

This market has been very tough to short and I will not load up on put positions. Given the upcoming FOMC meeting and the Greek deadline, I believe Asset Managers will be in "risk off" mode. They are not going to chase stocks when the market is at an all-time high. Forward P/E's are lofty (18) and bonds have been declining.

Yesterday, I bought back all of my bullish put spreads and I sold all of my low-priced stocks. I also day traded from the short side and made some nice profits trading SPY puts. For the first time in months, I finished the day with 100% of my capital in cash. The last two months have been excellent and I've managed to make good money in a directionless market.

I will be looking for small shorting opportunities, but I will not take my eye off of the prize. The best trade in the last few years has been to buy dips. I sense that the market is poised to pull back to the 100-day moving average. If the FOMC hints of higher rates and if Greece continues to play "chicken", we could test the 200-day moving average. I will be watching for support and when I see it, I will aggressively get long.

Look for weak price action today. The market was able to shoulder the early shock from a strong number, but I feel that the selling pressure will build.

The price action should be choppy the next two weeks with a negative bias.

Look for shorting opportunities and keep it small.

.

.

Daily Bulletin Continues...