Look For Choppy Trading and a Negative Bias Until the FOMC Next Week

SIGN-UP FOR THE WEBINAR and learn how to get the Platform with real-time quotes for FREE. I post my market comments to the Platform before the open each day.

Posted 10:40 AM ET - Last week we learned that 280,000 new jobs were created in May. That was much better than expected and traders are on Fed alert. The FOMC statement will be posted a week from Wednesday.

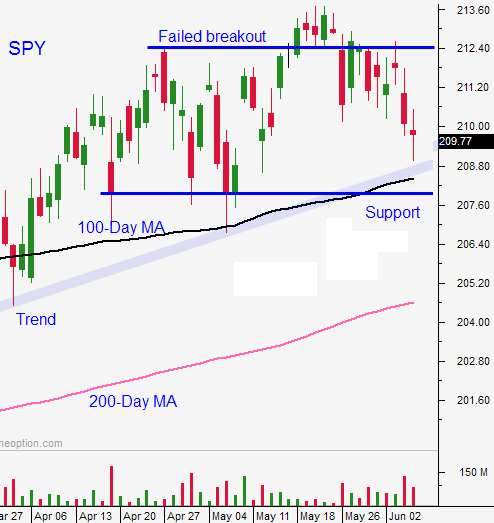

Most analysts are expecting a rate hike in September. If the Fed confirms that timetable, the market will decline. Stocks are looking for anything to trade off of and we could test the 200-day moving average. Ultimately, this will set up a nice buying opportunity. A quarter-point rate hike from 0% should not spook anyone.

Greece postponed its IMF payment and it bought itself another week or two. They leaked their proposal and so did creditors. The two sides are still far apart and this is likely to come down to the wire. The market hates uncertainty and we are likely to see nervous trading.

I believe the price action the next two weeks will be choppy with a negative bias. I am currently in cash and I will stick to day trading until these two events play out.

I have been buying low-priced stocks that are breaking through horizontal resistance. This strategy has been very profitable. When market volumes decline, option bid/ask spreads widen. I am giving up too much of an edge when I trade options, especially when my holding period is only a day or two. Stock bid/ask spreads are very tight and I can get in and out with ease. I also don't have to worry about time decay. These breakouts tend to produce a sustained directional moves and these stocks held up well during last week's market decline.

If the Fed hedges its statement and Greece agrees to a deal, the market will rally. If the Fed hints of tightening in September and Greece "plays chicken", the market will decline. I won’t participate in this crap shoot.

Bull markets don't worry about quarter-point rate hikes and they don't worry about tiny little countries like Greece. Resistance is building and we are in the late stages of this 6 year rally. The market has been stuck in this range for more than 6 months and no one is worried that they will miss the next leg higher.

Global economic conditions are fragile. US growth will be lucky to hit 2% this year and Europe is growing at .3%. China's economy is slipping and the PBOC has been forced to ease. China will post IP and retail sales this week.

The market is within striking distance of the 100-day moving average (SPY $208.50) and I believe it will be tested this week. Asset Managers are not going to chase stocks at an all-time high with major news pending. They will pull bids and bullish speculators will get flushed out. Next week's FOMC statement could push us down to the 200-day moving average if the comments are hawkish.

If we get the pullback I'm looking for, a fantastic buying opportunity will surface. We won't have to wait long for this news. Be patient and keep your size small.

The price action this morning suggests a quiet day.

.

.

Daily Bulletin Continues...