Market Could Test the 200-Day MA Before the FOMC – Register For the Free Webinar Wed

SIGN-UP FOR THE WEBINAR

Before I get to my market comments, I want to make you aware of a very important webinar taking place Wednesday evening at 8:00 PM ET. 1Option has just interfaced with one of the fastest growing online brokerage firms

Here are 4 reasons you should attend:

1. I will show you how to dramatically reduce your commission costs

2. I will show you how to get my 1Option Platform with real-time quotes – FREE.

3. I will show you how to get 1Option Scanner FREE. This is the cornerstone to my research.

4. I will use the 1Option Platform and Scanner to find 5 new trades

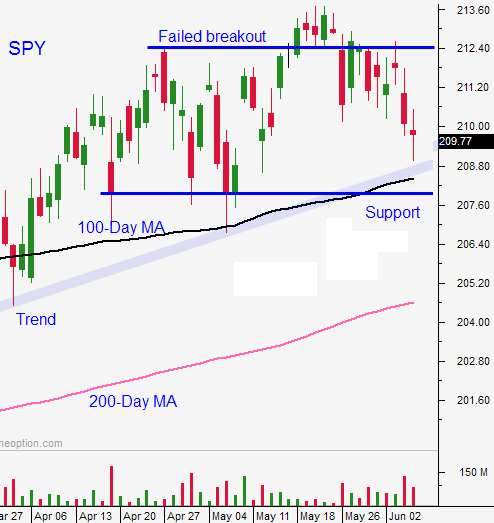

Posted 11:50 AM ET - Yesterday, the market drifted lower and it challenged the 100-day moving average. Overseas markets were weak and the downside was tested this morning. Stocks have bounced and support is holding.

Traders are bracing for the FOMC meeting next week. Most analysts believe that the Fed will raise rates in September. Janet Yellen will gently set the tone during her statement next week. The market won't like the news, but the damage should be relatively contained.

European markets have rallied on central bank easing. Greek credit concerns are prompting some investors to take profits.

China's stock market is up 40% this year and it is showing signs of strain. We've seen two overnight declines that were greater than 5% in the last few weeks. They will post retail sales and industrial production Thursday morning. This price action is toppy.

As I mentioned yesterday, I believe stocks will have a negative bias into the FOMC meeting (June 12th). Asset Managers are not going to chase stocks at an all-time high when they're trading at a forward P/E of 18 and when major news is pending. The bid will be soft and bullish speculators will get flushed out. I believe we could pull back to the 200-day moving average.

If this scenario plays out, we will have an excellent buying opportunity. Janet Yellen will find a way to hedge her comments and Greece/Europe will find a way to "kick the can down the road". The market will bounce and it will rally back to the middle of the range.

I am currently in cash and I am day trading from the short side. I don't like taking overnight shorts when one central bank statement can spark a massive overnight rally. This is still a low probability trading environment and the market lacks direction.

The best trade will come after a decline when support is established. Buying dips is still the way to go and I am keeping my powder dry. If we get the pullback I'm looking for, I will sell out of the money put credit spreads in July.

Look for choppy trading with a negative bias until the FOMC. This dark cloud will pass and an excellent buying opportunity will present itself. Be patient and keep your size small.

Daily Bulletin Continues...