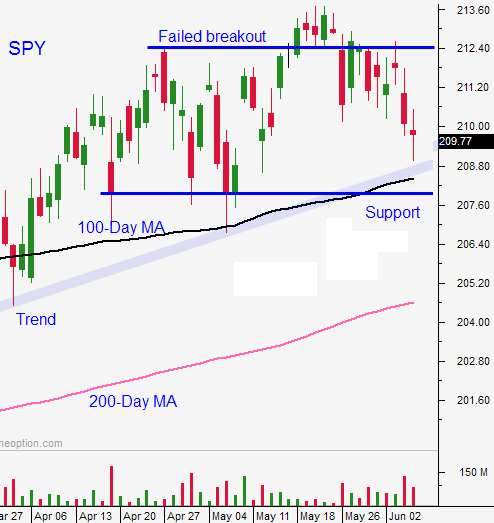

Market Found Support At the 100-Day MA – Expect More Selling Into the FOMC

SIGN-UP FOR THE WEBINAR

Before I get to my market comments, I want to make you aware of a very important webinar taking place tonight at 8:00 PM ET. 1Option has just interfaced with one of the fastest growing online brokerage firms

Here are 4 reasons you should attend:

1. I will show you how to dramatically reduce your commission costs

2. I will show you how to get my 1Option Platform with real-time quotes – FREE.

3. I will show you how to get 1Option Scanner FREE. This is the cornerstone to my research.

4. I will use the 1Option Platform and Scanner to find 5 new trades

Posted 11:50 AM ET - Yesterday, the market probed for support and the 100-day moving average held. The price action remains choppy and we are likely to see nervous trading with a negative bias ahead of the FOMC next week.

Wage inflation grew 3% in April and it grew 3.2% in May. These are the highest levels since the financial crisis in 2009. Wages are the primary input cost for companies (by far) and this will put upward pressure on prices. Consequently, the Fed is likely to raise interest rates in September.

During the FOMC meeting next week, Janet Yellen will set the timetable for a quarter-point rate hike. The initial reaction will be negative, but this news is widely expected so the damage should be contained. As long as the rate hike is accompanied by economic growth, the market will shoulder the news.

Greece and the ECB/IMF remain miles apart. They need to secure financing next week and there is plenty of friction. Even if they get through this round of financing, the saga will continue.

China will post retail sales and industrial production tomorrow morning. I am expecting soft results. The PBOC has been easing and buyers will remain engaged. The MSCI decided not to include Chinese A-shares in the emerging market Index at this time and that could create a little selling pressure. China’s market feels a little toppy.

Stocks are posting nice gains this morning, but we should expect some selling before the FOMC.

Asset Managers are not going to chase stocks at an all-time high when major news is pending and when forward P/E's are lofty (18). This means the bid will be relatively "soft" and we could see a little profit-taking as traders reduce risk.

I am day trading and I am not taking any overnight positions. If we get the decline I'm looking for, I will be ready to fire. Until then, this daily movement is nothing but noise.

.

.

Daily Bulletin Continues...