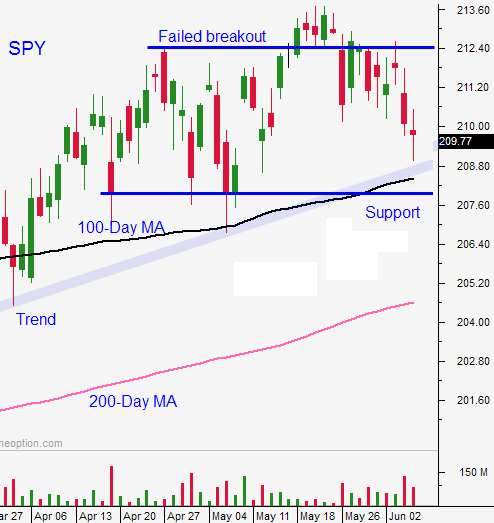

Rally Was Nothing More Than A 1-Day Bounce Off of the 100-Day MA – Nervous Trading Ahead

Open and account with Tradier Brokerage and get the 1Option Platform and the Scanner with real-time quotes for 2 weeks. It will only take a couple hours to get your account open and you don't even have to fund it to take the Free Trial. They offer the lowest brokerage rates I have seen and they will pay for the Platform and the Scanner if you hit minimal trading levels.

Posted 10:00 AM ET - Yesterday, the market staged a nice rally and we closed near the high of the day. Unfortunately, this move simply felt like a one-day bounce off of the 100-day moving average and I doubt we will see any follow through.

China's industrial production and retail sales were in line. Stocks in Asia are trading higher on that news and a rate cut in South Korea is helping.

European markets are also trading higher on the notion that Greece will strike a deal. Rumor has it that they will be rewarded with financing for every concession they make. This type of piece-meal solution is not market friendly.

US retail sales were up 1% and that is better than expected. The news is light and the FOMC meeting next Wednesday is the next big event.

Most analysts believe that the Fed will set the table for a September rate hike next week. Employment conditions are improving and we are seeing signs of wage inflation. The initial market reaction should be negative, but the damage will be contained.

Stocks are within striking distance of the all-time high and resistance will be stiff. Asset Managers will not chase the market near an all-time high when major news is pending.

I did not short the market last week even though my short-term outlook was bearish. Yesterday's bounce did not come as a surprise. I've mentioned in my comments that this market is almost impossible to short and that snapback rallies loom around every corner.

Likewise, I will not participate in this rally. We have not seen any follow-through in recent months and the market lacks a catalyst.

I am finding day trading opportunities and I am focusing on breakouts/breakdowns through horizontal resistance/support. If these moves are accompanied by high-volume and a trade signal for my system, the probability of success is high. I am using a "hit and run" tactic and I am flat after each trading day.

I am seeing some nice bullish put spreads opportunities on stocks that have been beaten down and that have found support. I am not entering trades until I see the FOMC reaction.

The best trade is to buy dips once support is established. Until we get one, my size will be small and my overnight positions will be limited.

Be patient and look for intraday opportunities.

I still expect to see nervous trading into the FOMC next week and we should revisit the 100-day moving average.

.

.

Daily Bulletin Continues...