Market Likely to Test the 200-Day MA In the Next Week. Be Ready To Buy

Do you want to get my market comments before the open ? I post them to my trading platform each day and I also post intraday updates on busy days. I am currently offering a 2 week trial of the platform and the scanner free if you open an account with Tradier Brokerage. This is a real-time streaming interface with advanced charting, stocks expert ratings, options analysis and much more. You can OPEN YOUR TRADIER BROKERAGE ACCOUNT in a matter of hours and you don't have to fund it to take advantage of this offer. My platform and scanner are the cornerstone to my research. Should you decide to continue, Tradier Brokerage will pay for both if you hit minimal monthly trading levels. Their commissions are the lowest I've seen. In case you are wondering, they do not pay me a penny. I wrote into their API because it is a great way for you to save money on your commissions and possibly get the platform and the scanner free with real-time streaming quotes if you trade through them.

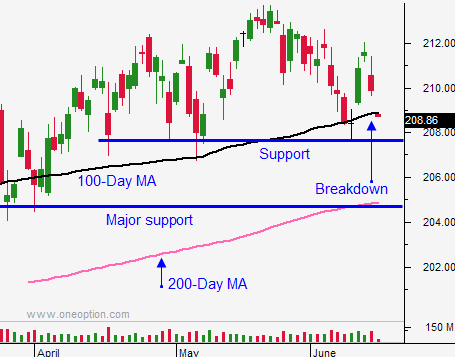

Posted 11:00 AM ET - I mentioned last week that Wednesday's rally was nothing more than a one-day event. Rumors circulated that Greece was close to a deal and the SPY bounced off of the 100-day moving average. As I outlined in my comments, the bounce failed and the market is testing the 100-day moving average.

The tone between Greece and the EU has soured. The timeline for a comprehensive solution draws near and they need to reach an agreement by the end of the week. In all likelihood, we will see a piecemeal solution and Greece will forever be skating on thin ice.

On Wednesday, the FOMC statement will be released. Most analysts believe that they will set a September timetable. Employment conditions are improving and we are seeing wage inflation. The likelihood of a quarter-point increase in September is very high. Janet Yellen will try to soften the blow, but the message will be clear.

I believe the market could test the 200-day moving average in the next week. A dip to this level will set up an excellent buying opportunity and I hope it happens.

The initial reaction to a Fed rate hike will be negative. However, most traders have been preparing for it for the last few months and the market will be able to shoulder the news.

Greece will probably be rewarded with financing for every spending constraint it agrees to. There is not a lot of wiggle room and they need every dime. This type of solution will not be market friendly, but it will keep stocks from tanking. If Grexit occurs, it will be short term bearish and long-term bullish. The ECB/IMF/sovereigns hold 85% of their debt and the chances of contagion are small. If Greece is booted out, it will send a strong message to other EU members.

Economic numbers will be light for the next few weeks. Europe and the US are treading water at meager growth levels and China's growth continues to slip gradually.

If we don't get a big move down this week, we will fall into a very tight trading range.

Asset Managers won't chase stocks at an all-time high, but they will buy dips. If we get the decline I'm forecasting, sell out of the money bullish put spreads once support is established. This could be your last chance to get a good trade-off this summer. Depending on the move, I might also buy some August calls.

I am day trading until I see the FOMC reaction. I want to keep my powder dry so that I'm ready to fire if we get the decline.

We won't have to wait long; we are only a few days away.

Be patient and look for nervous trading into the FOMC. We are below the 100-day moving average and we should see additional selling this afternoon. If you're day trading from the short side, use the 100-day moving average as your stop.

.

.

Daily Bulletin Continues...