Dead Till the Fed – Any Decline Will Be Brief – Be Ready To Sell Bullish Put Spreads

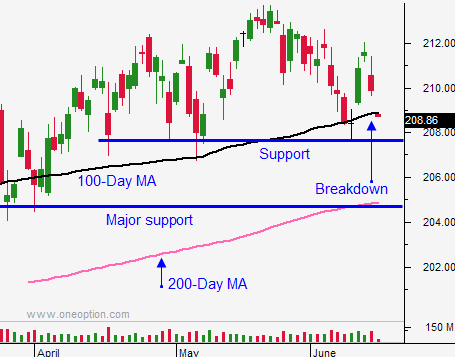

Posted 12:00 AM ET - There's not much to report today. The SPY is hovering around the 100-day moving average and we are likely to stay in a tight range until the FOMC statement tomorrow.

Most analysts believe that the Fed will raise rates in September. They will highlight improving labor conditions and an inflation rate that is below their target (using PCE as the metric). Janet Yellen is not likely to set a timeline and she will choose her words very carefully. Any change in the rhetoric that points to a September rate hike will result in a market decline.

I believe any substantial market decline will quickly find support. Economic conditions are gradually improving and the market is prepared for a tiny quarter-point increase. I am hoping for a decent selloff so that I can sell out of the money put credit spreads.

Greece continues to skate on thin ice. The rhetoric is heated and they only have a few days to work out a deal. If they can't reach an agreement, a piecemeal solution is likely. Greece will get financing for every concession they make. This has the potential to quickly escalate and we could see Grexit this summer it this path is taken.

If Greece is booted out, it would be short term bearish. Credit risks are contained and European banks have very little exposure. After the initial shock, European stocks could rebound. This dark cloud will finally pass and a clear message will be sent to other EU members.

The Fed and Greece are the only two newsworthy events the rest of the month. If they fail to spark a move, we will chop around in a tight trading range and the summer doldrums will set in.

We will know in the next couple of days. Be patient and wait for a decline. If we get it, it could be brief and you will have to act quickly.

The price action has settled down and we are "dead till the Fed". Look for dull trading until the FOMC statement.

.

.

Daily Bulletin Continues...