Here’s How To Trade the FOMC – It Is Getting More Attention Than It Deserves

FREE WEBINAR TONIGHT with 5 new trades. I will use my platform and scanner to find these trades and I will tell you how to get them free.

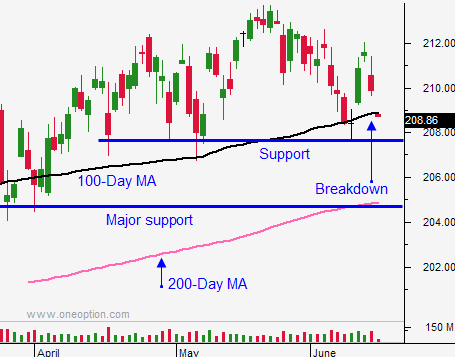

Posted 10:00 AM ET - The market is always looking for the next big news event and June 17th has been marked as a key day on the calendar for a long time. We are in a news vacuum and the FOMC statement is garnering more attention than it deserves. Unfortunately, I believe that at best the FOMC statement will only fuel a move to the high-end or the low-end of the range (SPY $208 or $214).

The Fed has hit its employment targets and wage inflation is starting to surface. Wages were up 3% in April and 3.2% in May. These are the biggest increases since 2009 and higher wages have the greatest impact on inflation. The Fed knows that it needs to raise rates.

The market is prepared for quarter-point rate hike in September. Bond yields have already started to rise. The FOMC statement will change a few words here and there and the probability of a rate hike in September will rise. Stocks could retreat on the news even though Janet Yellen's remarks will try to soften the blow. A definitive "one and done" statement with a September timeline might actually be bullish, but I don't think it will happen.

The market is numb to Greece. Risk exposure is limited to the IMF/ECB/Sovereigns and banks hold very little Greek debt. Talks are deteriorating and the market does not care. Any market decline related to Grexit will be a buying opportunity.

So here is how I'm playing the FOMC. I will wait for 10 minutes to let the dust settle. If there is material news and the S&P 500 moves more than 10 points, I will join the momentum. This will only be a day trade. If we get a muted choppy reaction I will stay sidelined.

From a swing trading perspective, if the market rallies, I will stick with my current strategy of buying low-priced stocks that are breaking out. This tactic has been extremely profitable and the stocks I'm trading have been moving 5 to 10% in a couple of days. I have fantastic liquidity since I'm trading the underlying stock and I don't have to worry about time decay. I already know the demand for the shares is high. Unlike the market, these stocks want to run. If I bought SPY calls, I would run the risk of losing money on another failed breakout.

If the market declines on the FOMC statement, I will be waiting for support. I want to sell out of the money bullish put spreads. I was hoping for a decline down to the 200-day moving average, but I don't know if we will get one. It would take a combination of bad news in Greece and a negative reaction to the FOMC statement to get us there. At this stage, I feel that we might only drop to the 100-day moving average. I would still be happy selling bullish put spreads at that level.

The global economic news has been predictable and sluggish. Stocks are trading at lofty forward P/E's and Asset Managers won't chase. These two factors are keeping a lid on the rally. Central bank money printing has resulted in miniscule bond yields and there is a lack of attractive investment alternatives. This is keeping a bid to the market. It will be very difficult for the market to breakout of this eight month range.

Keep your size relatively small into the FOMC statement. Wait for the news and use the guidelines above.

The trading activity should be relatively quiet into the release.

.

.

Daily Bulletin Continues...