Market Will Drift Up To the All-time High and Stall Next Week

I hope you attended last night's webinar. I highlighted 27 stocks and only 1 is trading lower (-$.50). We have many big winners and one that is up $10. WATCH THE WEBINAR

Posted 10:45 Am ET - Yesterday the FOMC changed some of his rhetoric and it continues to monitor the "dots". Inflation is slightly below the target due to the recent PCE deflator and they cited stable employment conditions. Janet Yellen's remarks were very dovish and the market rallied slightly on the news.

What I found to be interesting is that all but two Fed officials expect an interest rate hike in 2015. In fact, the majority believes there will be two rate hikes in 2015 and the average expectation for the Fed Funds rate is .375% by the end of the year. The market can shoulder one rate hike, but to rate hikes could spook investors and I believe it is unlikely.

The Fed lowered GDP growth projections to 1.9% for 2015. This is meager growth. Europe is only growing at .3% and China's growth continues to slip.

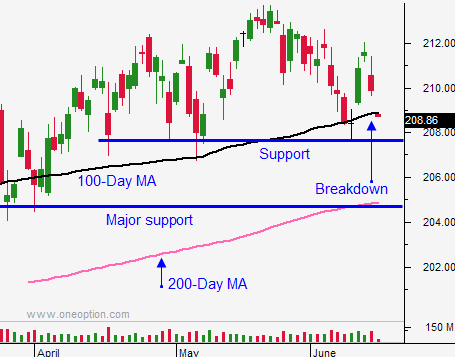

The initial reaction to the Fed was fairly muted and we are seeing follow-through buying today. The SPY is likely to challenge the all-time high next week.

I am not looking for a massive breakout. Asset Managers will not chase stocks at an all-time high when they're trading at a forward P/E of 18. Economic growth is sluggish and interest rate hikes are looming.

Once this initial euphoria wanes, the market will drift back to the middle of the trading range. Prepare for the summer doldrums.

Our best chance for a trading opportunity has passed and we needed a negative reaction.

Traders are numb to Greece. Almost all of their debt is held by the ECB/IMF/Sovereigns and the risk of a credit crisis is small. The talks are deteriorating and the deadline for a deal is upon them. It is possible that Grexit could spark a rally.

I am going to stick with my current strategy. I'm buying low-priced stocks that are breaking out. Most of these plays are making 5 to 10% (unleveraged) in a few days. If the breakout fails, I get out. If the momentum stalls, I take profits and move to the next trade. I hosted a webinar last night and I gave attendees 27 stocks to trade. All but 3 are making money and the biggest loser is down $.50. We have a $10 winner - you would be amazed at how well these stocks are doing.

It took me 20 minutes to find the stocks using the platform and the scanner. I am currently offering a two week free trial for both when a Tradier Brokerage account is opened. This will also allow you to pull real-time streaming quotes into the platform and you will be able to trade through the platform.

Flash PMI's are the next big news event and they will be posted Tuesday. I'm not looking for any fireworks.

Stocks will continue to grind higher for a few days and the market will challenge the all-time high. Resistance will build and the volume will drop off as we head into another news vacuum.

Buy stocks that are breaking through horizontal resistance and that are accompanied by high-volume. If you do buy calls, buy in the money options that have a high Delta so that you can avoid time decay.

.

.

Daily Bulletin Continues...