Resistance Is Stiff – Greece and China Have Me Treading Cautiously – Hit and Run

WATCH THE WEBINAR

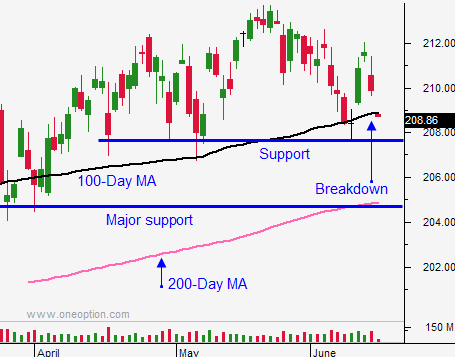

Posted 9:30 AM ET - Traders digested Yellen's remarks after the FOMC statement and they liked the dovish tone. Once the momentum was set Thursday, stocks floated higher. The SPY is only 1 point from an all-time high and we could test it today or next week. This was nothing more than a relief rally and quad witching fueled the move.

The average Fed Official sees the Fed Funds rate at .375% in 2015 and that implies at least one rate hike this year.

Like every other attempt at a breakout this year, resistance will build and the market will sink back into the range. We are headed into another news vacuum and the next big release is Tuesday (flash PMIs).

Greek talks are not going well and leaders are visiting Putin for possible financing. They seem willing to dance with the devil.

China's market fell 13% this week and it was down 6% overnight. Higher brokerage margin requirements, a wave of IPOs and a fear that monetary easing might subside has sparked profit taking. China’s market was up 50% YTD in May and it feels toppy.

US Stock valuations are a bit stretched and Asset Managers will not chase at an all-time high. Economic conditions are stable, but growth is sluggish. The Fed lowered 2015 GDP growth projections to 1.9%.

I don't see a catalyst for a breakout.

Watch my webinar and you will know the pattern I am trading. The 27 stocks I highlighted did great Thursday and we even hit an $8 winner.

Look for stocks that have consolidated and that have broken through horizontal resistance on strong volume. If the breakout fails, get out. If the momentum stalls take profits. I am also taking profits if a stock runs up 5-10% in a day. We have hit many of these in recent weeks and I nailed an 8% gain day trading shares of BCRX yesterday.

I don't want to sell put spreads up here. One small market whiff could put my spreads in peril and option IVs are very low. We are not being rewarded for the risk.

If you are buying call options, go ITM where the deltas are high. You want to avoid time decay.

The market will float up to SPY $214 next week and it won't help or hinder our current strategy. Prices are getting a bit stretched up here and I will only have a few positions after the close today.

Greece and China have me treading cautiously.

Look for choppy trading today - quad witch.

.

.

Daily Bulletin Continues...