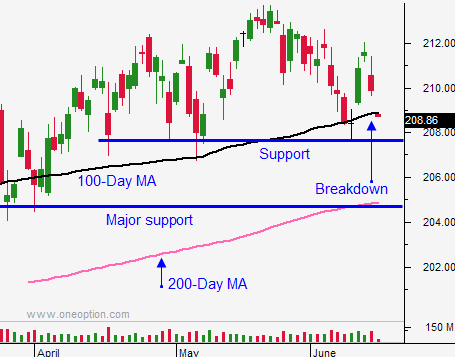

Look For Choppy Range Bound Trading This Week – SPY $208-$212

Posted 10:00 AM ET - Last week, the market declined into the FOMC statement and we saw a big relief rally on Thursday. Stocks drifted lower on Friday and they sold off hard into the closing bell. This morning, the S&P 500 is up 15 points. I'm giving you the play-by-play because we are back where we started and this price action is nothing but noise.

If you look at today's chart, you’ll notice that we haven't gone anywhere since March. I'm trying not to read too much into any of these moves. Quite honestly, I did not see anything in the FOMC statement to justify the rally on Thursday. Greece does not have a deal and I don't see any reason for today's rally.

European officials looked at the latest proposal submitted by Greece and apparently they made some concessions. Unfortunately, European officials said that this is a good starting point. That tells me they are still miles apart.

If Greece kicks the can down the road, this saga will continue. The market will chop back and forth this summer and we are likely to fall into the summer doldrums.

If Greece defaults, we could see an excellent trading opportunity. The market will have a negative initial reaction. Credit risk exposure in Greece is low in the private sector. This decline should be short-lived and I will buy on support.

My game plan is simple. I will stick with what is working. I like buying low-priced stocks that are breaking through horizontal resistance. I stick with these trades one to three days and I exit when the momentum stalls. This hit and run strategy is working great and my overnight risk exposure is small.

If we get a decent market pullback to the 100-day moving average, I will also sell bullish put spreads. I don't want to sell any until Greece strikes a deal or defaults. Option implied volatilities are very low and I'm not being reported for taking the risk (I have to go too close to the money to get a decent premium).

In the unlikely event that we get a substantial decline down to the 200-day moving average, I will buy SPY calls (in addition to the other 2 strategies).

I still prefer trading from the long side. Central banks are easing and the market bid is strong.

Try to ignore comments that justify every market wiggle and jiggle. Buyers and sellers are paired off and the market lacks a catalyst.

The news is light this week. Flash PMI's will be released tomorrow and there is fear that the PBOC might be done easing. China's market was down 13% last week and a soft number could spark additional selling. Brokerage firms in China are raising margin requirements and there have been a number of IPOs recently. China's market is up 40% this year and there is room for profit-taking.

The drop dead date for Greece is a week from today.

There are enough negatives in the marketplace to keep resistance at the all-time high intact. Look for choppy range bound trading this week (SPY $208 - $212).

.

.

Daily Bulletin Continues...