If Greece Strikes A Deal the Market Will Challenge the Highs and Stall

GET THE PLATFORM AND SCANNER FREE with real-time quotes. I post my forecast to it each day before the open.

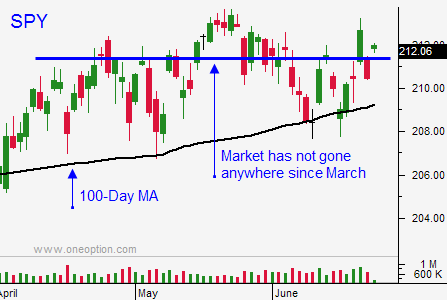

Posted 11:30 AM ET - The market is likely to challenge the all-time high and stall. Rumor has it that Greece made substantial concessions and they might strike a deal that lasts the rest of the year. If this plays out, we won't get a selloff and the summer doldrums will set in.

Flash PMI's were in line. China was spot on, Europe was a little better than expected and Japan was weaker than expected. In the US, durable goods orders fell 1.8%.

We are in a news vacuum until the jobs report on July 2nd. That is just before a major holiday and trading volumes will be light. Earnings season will kick off in a few weeks and there will be some movement within the market. On July 29th we will have the last FOMC meeting before they go on recess (next meeting is in Sept and we could get the first rate hike then).

The market is searching for a catalyst and there aren't any in sight. Asset Managers won't chase stocks at a forward P/E of 18 when a rate hike looms. Global economic conditions are sluggish and resistance is stiff at the all-time high.

There will be opportunities within the overall market and I will be focusing on individual stocks. Right now, we are seeing a rotation into financial stocks and there are some buying opportunities.

I won't consider selling bull put spreads until Greece signs a deal. Option implied volatilities are at historic lows and you have to go close to the money to get a decent premium. One small event could spark a decline and that would instantly spell trouble. Bullish put spreads do not currently have an attractive risk/reward profile.

I will find stocks that have recently been beaten down and that have formed support. As long as the long-term fundamentals are in place, I will consider selling bullish put spreads on some of these candidates (if Greece signs a deal). This will be a relatively minor portion of my trading activity.

As you know from my comments, I prefer to trade low price stocks that are breaking through horizontal resistance. Specifically, I'm looking for price consolidation, a breakout through horizontal resistance, a volume spike and a buy signal for my trading system. When all of these elements are present, the probability of success is high and I've been able to capture 5 to 10% moves in a few days. This strategy is working well and it will continue to produce during these "dog days".

If I have the same elements and the stock has options, I am buying deep in the money calls with a high delta. I don’t want exposure to time decay and I am trading August expiration so that I don’t have to roll the position if I get on a longer term move.

Look for quiet trading the rest of the week. If Greece strikes a deal, we will challenge the highs. At worst, they will find a way to kick the can down the road for a few weeks. I don't believe we will see a major decline this week.

Favor the long side and keep your risk exposure small.

.

.

Daily Bulletin Continues...