Market Is Flat and It Won’t Budge – Look For Pockets of Strength Within – Buy Breakouts

GET THE PLATFORM AND SCANNER FREE with real-time quotes. If you open an account with Tradier Brokerage Inc. you don't have to fund the account to get real-time data. Then take the FREE 2 week 1Option Platform and Scanner trial with real-time quotes. If you start now, you can start finding trades this afternoon.

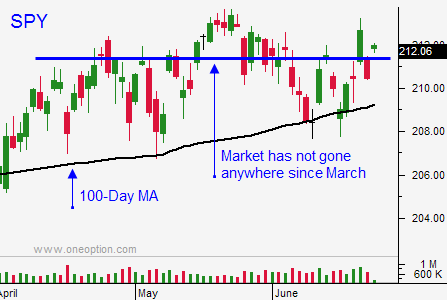

Posted 11:15 AM ET - The market has not gone anywhere since March and a quiet stretch lies ahead. The upcoming holiday will suck the life out of the market and the reaction to the jobs report next Thursday will be muted.

Stocks tested the downside this morning when Greece said that creditors have not approved their recent proposal. Greece is the only wildcard we have.

Greece is likely to strike an agreement of some type. It could be a six-month solution or it could be a piecemeal agreement. In either case, stocks will float higher on light volume if this plays out. The rally will be vulnerable and profit-taking could strip profits away quickly.

If Greece does not secure financing, the market will decline. From a trading standpoint, this would set up an excellent buying opportunity. Credit risk is contained and Grexit would actually be long-term bullish for Europe. I would put the probability of this happening at less than 20%.

Earnings season will kick off in a couple of weeks and there will be individual news stories to trade. The next FOMC meeting is July 29th and they will not meet again until September. That is when most analysts are expecting the first rate hike.

Global economic conditions are stable, but sluggish.

You can tell from my tone and from the calendar of events that I believe we are going to fall into the summer doldrums. Trading volumes will dry up and the market will wait for anything it can sink its teeth into.

There are plenty of opportunities within the market and that is my focus. Sector rotation will spark breakouts and that is what I'm currently trading. My focus is on low-priced stocks that have consolidated and that are breaking through horizontal resistance on heavy volume. If my system is on a buy signal, the probability of success is high.

After Greece signs a deal, I might sell some bullish put spreads on stocks that have been beaten down. Option implied volatilities are extremely low and the risk/reward profile for this strategy is poor. There is still a chance that Greece could screw this up. I don’t want to take that chance so I will wait for the news.

Look for very quiet trading the rest of the week.

.

.

Daily Bulletin Continues...