China Is A Bigger Factor Than Greece – 200-Day MA Will Fail Today

FREE TRADING WEBINAR Wednesday. We have been focusing on 1 specific patter and making a killing. I will show it to you and find trades Wed night. Yesterday I went 10 for 10 day trading it and we are long puts today. Sign up now.

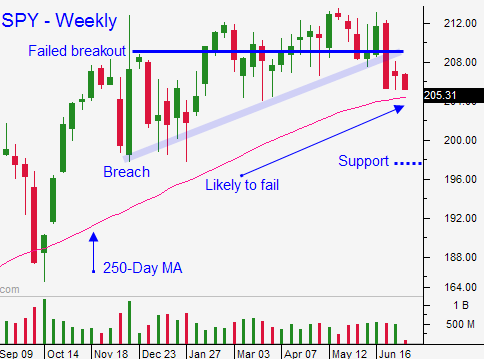

Posted 10:30 AM ET - Yesterday the market probed for support after a "No" vote in Greece. The S&P 500 was able to find support above the 200-day moving average. The price action this morning is soft and that level will be challenged.

We don't know the outcome in Greece and we don't know the reaction. Will the EU cave-in to Greek demands? If they do, is this market friendly? On a longer-term basis, I believe Grexit would be bullish for European markets. It would send a message to other EU members. Kicking the can down the road will simply open the floodgates for negotiations with other PIIGS nations and I think that would be bearish.

This is a binary event and we need to wait for the outcome.

It's important to keep things in perspective. The market crash in China during the last two months has destroyed wealth equal to 10 times the GDP of Greece. Their market is still up from a year ago, but this decline will impact confidence. China's economic growth is fragile and consumers are likely to tighten their purse strings.

With regard to China, you might think "easy come – easy go". The US market had a big rally in 1987 and in 2000. Both resulted in a nasty declines and the emotional impact lingered for years.

China's market was down more than 5% yesterday and government intervention did not stabilize prices. There could be much more downside.

Earnings season will begin Wednesday. Big banks (JPN, WFC and BAC) and Intel will announce next week, but the major releases are still two weeks away. Stocks tend to rally into earnings season and this should keep buyers engaged.

The FOMC minutes tomorrow won't generate much of a reaction since the FOMC statement was benign.

I believe China's woes are having a bigger impact on the market than Greece. We are within striking distance of the 200-day moving average and I believe it will be tested today. A close below the support level would lead to additional selling.

Regardless of the reason, I hope we get a nasty decline down to SPY $197.50 or lower. That would set up an excellent buying opportunity.

We are in a news vacuum and the market is searching for a catalyst. Until we breakout/breakdown, I will stick to day trading. We've been making a killing in the chat room trading a very specific pattern. Yesterday I had 10 letters out of 10 trades and I played both sides of the market. This strategy is working well and I don't have any reason to change. The bonus is that I don't have any overnight risk exposure.

Look for bearish price action today and a test of the 200-day moving average. I believe it will be breached today and I will favor trading from the short side.

.

.

Daily Bulletin Continues...