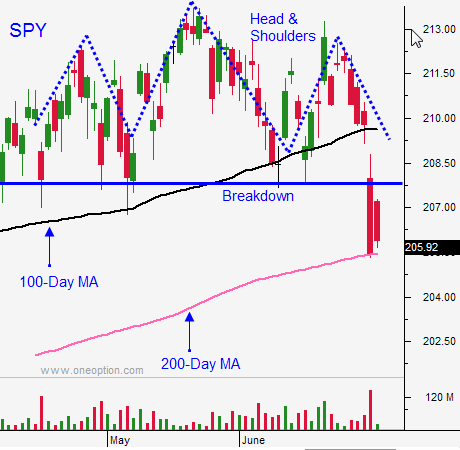

Greece Surprises Traders – Adjustments Could Spark A Breach of the 200-Day MA Today

Posted 9:30 AM ET - Greece voted NO to the final EU proposal and many analysts viewed this as a YES vote to leave the union. European officials are meeting to discuss their next plan of action and they are likely to throw a lifeline to Greek banks this week while they decide.

We are suffering from a post-holiday hangover and trading volumes will be light. This is a binary event and in the absence of other news, it will drive the price action. I will be trading from the short side today, but I will not hold overnight positions.

Most traders were positioned for a YES vote and they will need to adjust. The selling pressure has been relatively contained this morning. I believe stocks will try to rally early in the day and they will stall in the first hour. The selling pressure will build and we will gradually drift lower. If the selling pressure builds, we will hit an air pocket and easily take out the 200-day moving average.

The likelihood of Grexit is now greater than 50%. It is unusual for the borrower to dictate terms to the lender. European officials are running out of patience and a default is very possible.

We could be reaching a point where Grexit would result in a rally. It would send a clear message to Spain, Italy and Portugal.

I don't know how this will play out, but I am hoping for a nasty decline. Regardless of the decision, it will set up an excellent buying opportunity.

Earnings season will start Wednesday. This will keep buyers engaged. Major announcements are still more than a week away.

The FOMC minutes on Wednesday should not generate much of a reaction. The FOMC statement was relatively benign two weeks ago.

Last week my best trades came on the short side and that is where I will focus my attention. I did sell a few bullish put spreads (very small) and I will reel those back in this morning.

If you're a day trader, the action should be decent this week. Prices will chop back and forth while the decision is being made.

If you are a swing trader, keep your powder dry. We still need to see how this plays out.

.

.

Daily Bulletin Continues...