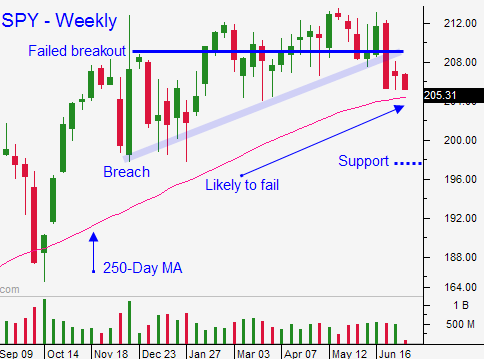

Market Support Likely To Fail Today – A Gradual Decline Is the Key

FREE TRADING WEBINAR tonight. We have been focusing on 1 specific patter and making a killing. I will show it to you and find trades Wed night. Yesterday I went 10 for 10 day trading it and we are long puts today. Sign up now.

Posted 11:30 AM ET - Yesterday, the S&P 500 breached the 200-day moving average. Stocks rebounded sharply during the day and typically a reversal of this nature will spark follow-through buying the next day. Stocks are challenging the 200-day moving average again today and weakness in China is a concern.

Chinese officials have instituted measures to prop up their market. Trading has been halted and these actions are not helping. This decline will have a lingering psychological impact and it will affect consumption.

By comparison, Greece is a blip on the radar. European officials have extended the timeline for an agreement and the new deadline is Sunday. Greek officials are likely to use all of the time.

The FOMC minutes will be released later today and given the benign nature of the FOMC statement, I'm not expecting any fireworks.

Alcoa will kick off earnings season today, but the major announcements are still two weeks away.

The reversal yesterday could mark a nice short term buying opportunity, but it was not a capitulation low. The SPY is only 3.5% off of its high and we need to see a substantial decline before we see anything close to a capitulation. If this bounce gains traction, it will only last a week or two.

Bullish speculators are likely to rush in today when the 200-day moving average is tested. They could have the door slammed in their face.

If the market finds support before the low of the day can be tested, we will rebound and we can start selling bullish put spreads.

If the market gradually drifts lower and we fall below the 200-day moving average, the selling pressure will accelerate and we will hit an air pocket. This is a major horizontal support level and it is the 200-day moving average. If it fails, it will be a significant breach.

Consumption in China will be impacted by the market decline. June auto sales fell 3.2%. This is the first decline in two years. Much of Apple's revenue gains came from China and it could be affected. Use Apple as a barometer. If it falls below $120, we could be in trouble.

Use the scenarios I outlined as your guideline and tread cautiously. News is still pending. We want to see Chinese stocks stabilize. Greece won't matter much one way or the other, but I suspect Grexit.

.

.

Daily Bulletin Continues...