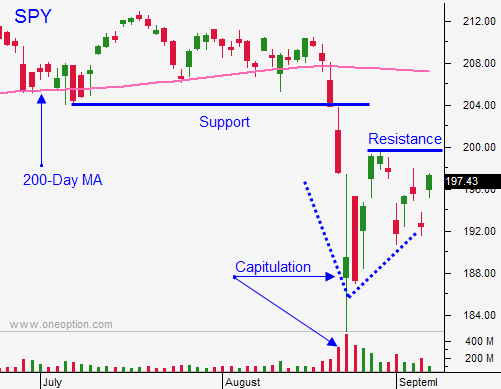

Market Will Hit Resistance At SPY $200 – Watch For Late Day Selling

WATCH US MAKE MONEY IN THE CHAT ROOM TODAY

Posted 9:30 AM ET - Yesterday, the market staged an impressive rally and it closed on the high of the day. We are seeing follow-through buying this morning and resistance at SPY $200 will be challenged. I would not read too much into these moves – they are all noise.

The FOMC will release its statement a week from tomorrow. This date has been marked on the calendar since January and the reaction will be violent. Quadruple witching will add fuel to the fire and option implied volatilities will remain elevated.

China announced another round of stimulus. Infrastructure spending and tax reductions on dividends attracted buyers overnight. China has thrown the kitchen sink at their market decline in recent weeks. They devalued their currency, they cut interest rates, they lowered bank reserve requirements, they purchased stocks, they increased government spending in they reduced taxes on dividends. These are acts of desperation.

Central banks around the world have been trying to artificially prop up economic growth and it hasn't worked. This is like trying to blow up a balloon with a hole in it.

If China's growth continues to slow, credit concerns will surface. Decades of hyper-growth creates bubbles. I don't believe credit will be an issue in 2015, but it could be in 2016.

If the Fed postpones a rate hike, the market will rally. The move will stall before we challenge the all-time high and traders will scrutinize holiday spending. The price action will be choppy with a slight upward bias. This would not be the most favorable trading scenario.

If the Fed hikes rates next week, the market will tank. It could test SPY $182. That move would be brief and it would present a fantastic buying opportunity if the Fed implies "one and done". Seasonal strength would spark a massive rebound and buyers would embrace the idea that our economy is strong enough to stand on its own two feet.

I expect volatile conditions for the next two weeks. Swing traders should wait until the FOMC statement. We are heading into a binary event and it doesn't make sense to hold overnight positions.

I am day trading. Once the momentum is established, I follow the trend. When the move stalls, I take profits. Prices have a tendency to compress and I wait for a breakdown or a breakout from that consolidation. Once the new direction has been established, I take a position and I repeat the strategy. Sometimes the moves continue (like yesterday) and sometimes they reverse (like last Friday).

Buyers will try to push the SPY through $200 today. I believe that resistance level will hold this week.

.

.

Daily Bulletin Continues...