Great Market For Day Trading – Use Price Compressions To Enter Trades

Posted 11:30 AM ET - The market is bouncing this morning after a nasty decline last week. Global markets were generally up overnight and that attracted buyers. I would not read too much into any of these moves. Stocks will be volatile through option expiration.

China's trade numbers were slightly better than feared. Exports declined 5.5% and imports declined 13.8%. These are dismal numbers. China's retail sales and industrial production will be posted over the weekend.

Chinese officials claim that this speed bump has run its course and that their economy will grow 7% per year as the middle class ramps up consumption. This sounds like wishful thinking. Decades of hyper-growth have created bubbles and the PBOC devalued their currency, lowered interest rates and slashed bank reserve requirements to avoid a crisis.

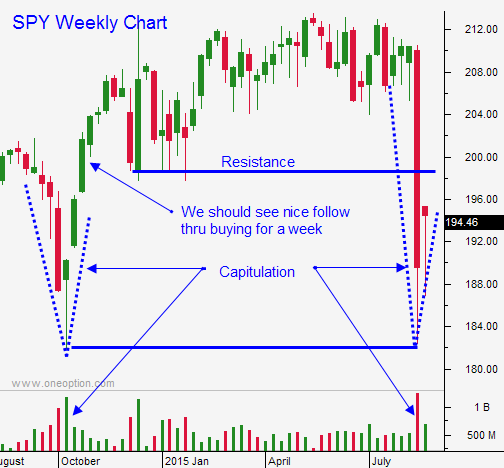

I believe the decline in China is temporarily overblown. We should see a market bounce and that will help the S&P 500 into year-end.

In 2016, I believe China's economy will continue to slip. The big unknown is credit risk. We don't know if the government will step in to prevent a credit crisis in their shadow banking industry.

Macro conditions are changing and I believe we will see a series of lower highs as the market continues to roll over in 2016.

I don't want to get ahead of myself and I just want to focus on the next 2 to 3 months.

If the Fed hikes interest rates, I believe the market will decline. That selloff would create an excellent buying opportunity. SPY $182 should hold.

If the Fed postpones a rate hike, the market will rally. That move will run its course over the next two months and the rally will stall before we get close to the all-time high. We will return to "Fed watch mode". Every word in the statement will be scrutinized and everyone will try to guess when liftoff will occur.

I would like to see us test SPY $182 next week after a rate hike and a “one and done” statement.

Option expiration and quadruple witching occur one day after the FOMC statement. I am expecting extreme market volatility. That means you can't sell premium ahead of the news. Option implied volatilities will stay rich right up until the announcement. This is a binary event and it is foolish to take a position ahead of the news.

Overnight moves like the one we are seeing today have been extreme.

If you are a swing trader, you have to wait until the announcement.

This is a day trading environment. Wait for momentum to be established and trade in that direction. Take profits once the momentum stalls and wait for a compression. If the market breaks out, get long. If the market breaks down, get short. I've use this tactic with excellent success. Some days we see continuation and some days we get reversals. These compressions provide excellent entry points.

Look for lots of nervous trading until September 17th.

.

.

Daily Bulletin Continues...