Great Day Trading Conditions – Nasty Market Reversal Wed – I Warned You

WATCH US MAKE MONEY IN THE CHAT ROOM TODAY

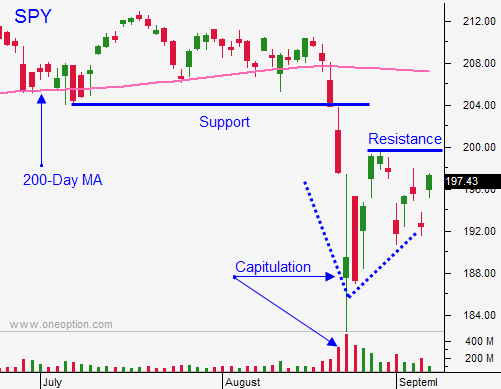

Posted 10:30 AM ET - Yesterday I told you the market would probe for support and to watch for late day selling. The S&P 500 rallied 20 points on the open and it finished 30 points lower. This was a massive 50 point reversal and I hope you capitalized on it. We can expect this type of volatility through quadruple witching.

I have been day trading based on the range during the first hour of trading and that strategy has been very effective. If the market is above the first hour high, trade from the long side. If the market is below the first hour low, trade from the short side. Follow the momentum and stay with the trend until it stalls. Take profits and wait for the compression to be resolved.

China has thrown the kitchen sink at their economic slow down. These measures should attract buyers and I expect to see a floor. China's CPI rose 2% and that was hotter than expected. It could keep the PBOC on the sidelines for now. New Zealand's central bank said that they believe China's growth rate is somewhere between 5% to 6.5%. Alibaba has lowered growth projections due to economic conditions and China's trade numbers were dismal this week. There are plenty of warning signs and they will post retail sales and industrial production over the weekend.

All eyes are focused on the Fed. This is a binary event and we can expect incredible volatility through quadruple witching a week from tomorrow.

I would like to buy a retest of SPY $182 after a Fed rate hike next week. They will soften the blow with "one and done" rhetoric. This move would instill domestic confidence and buyers would stop looking over their shoulder. A year-end rally could take us back to SPY $205.

Unfortunately, I believe the Fed will not raise rates. They have been dovish for six years and recent market volatility will keep them sidelined. The market will love the news and stocks will rally. That spike will be temporary and we will see a gradual drift lower once the momentum stalls. Prices will chop around and traders will dissect every FOMC word from now until March (next likely window for a rate hike). This is not the best trading scenario.

Swing traders - be patient. If the market rallies on the news, there will be nice trading opportunities. If the market tanks, you won't lose any sleep and you will be ready to buy once support has been established. This scenario has incredible profit potential.

Until then, we are in a day trading environment. Use the tactic I outlined above. Spend the first hour looking for stocks that have relative strength/weakness and you will make money in this volatile market.

I expect choppy trading in both directions today. The bias will be slightly negative after Wednesday's nasty reversal.

.

.

Daily Bulletin Continues...