Market Will Have Big Daily Ranges But No Follow Through – Asset Managers Adjusting Risk Into FOMC

WATCH US MAKE MONEY IN THE CHAT ROOM TODAY

WE WILL NEVER FORGET!

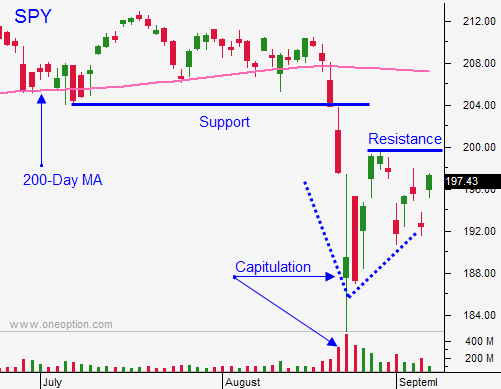

Posted 12:00 PM ET - The market tested the low and it looks poised to rebound today. Look for choppy trading as Asset Managers adjust risk heading into the FOMC next Thursday.

Sorry for the delayed post, but I have been busy trading this morning. We nailed some big trades in the chat room (long: PBYI, ABC and ILMN, short: ANET).

If you are an active trader you should take the free trial. We are making money every day.

Swing traders, stay sidelined until the FOMC. This is a binary event (hike vs no hike) and quadruple witching the next day will add to the volatility. I am expecting violent price movement and some aftershocks.

This is an ideal day trading environment. Look for relative strength/weakness and keep one eye on the market. When the market compresses on a five-minute basis and it breaks out, trade in that direction and use the stocks you have identified.

I used this strategy this morning. The market made a higher low and PBYI, ABC and ILMN remained stable. As soon as the S&P inched higher, the stocks took off.

I don't know how the market will react to the FOMC statement or what their decision will be. If they hike rates, I suspect we will test SPY $182. That would be an excellent buying opportunity once support is established and I hope this scenario plays out. I don't want to play this guessing game any longer and the market is prepared for liftoff. This would also send a vote of confidence.

If the Fed postpones the rate hike, it will be a sign of weakness. Stocks will initially like the news, but they will gradually sink lower.

For now, focus on day trading and take advantage of the volatility.

.

.

Daily Bulletin Continues...