Fed Loves To Screw Shorts – They Will Have the Perfect Opportunity Thursday

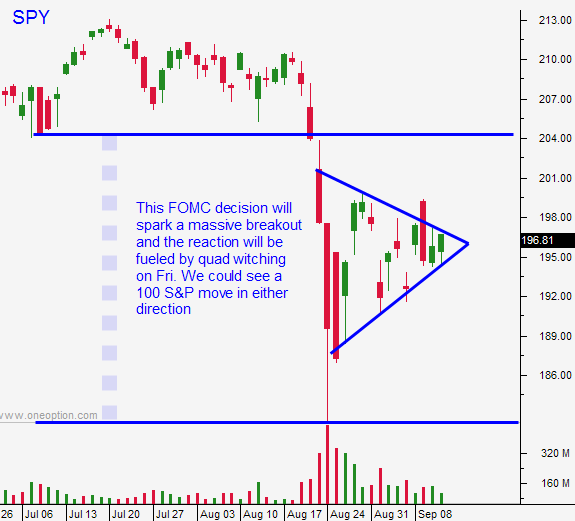

In the last seven years there have been countless instances where the Fed has screwed shorts. They make surprise decisions right before options expiration. If their intent is to stabilize the market, they will leave rates unchanged tomorrow. Friday is a “quadruple witch” and traders will only have one day to adjust September positions. This is like throwing gasoline on the fire and the market will jump.

A massive Fed induced market decline would be "irresponsible", but a massive rally would be just fine.

China recently used this same tactic. The PBOC made major announcements right after the closing bell a couple of weeks ago. The BOJ did something similar last year when they announced massive quantitative easing on the eve of options expiration. This is how central banks maximize their firepower.

The Fed has been dovish for six years and there is no reason to think they will change now. Global economic conditions are soft and we are seeing some signs of trouble domestically. Federal Express confirmed this when they posted earnings this morning. They cited weak global demand.

If the market stages an explosive move higher, the rally will stall. The bid will gradually crumble as soft economic data from China dribbles in. The debt ceiling and anxiety about the future liftoff will spark profit-taking into year end.

I hope the Fed has the nerve to raise rates. It is only a quarter-point and the economic impact should be negligible. This will send a clear message and we can stop looking over our shoulders. To soften the blow, the Fed could add "one and done" to the rhetoric.

The market would likely sell-off on the news and we might briefly challenge SPY $182. If this happens, I believe it would be an excellent buying opportunity. The market will gradually recover and we could have a nice year-end rally back to this level.

This is a binary event and the market will make a dramatic move. I will be “flat” during the announcement and I will evaluate the price action. Once the dust settles, I will know how to position myself.

It's funny to think that the SPY will probably finish the year right at this level. If we get a huge decline on a rate hike, we will rally back. If the Fed postpones the rate hike, we will see a big spike that gradually erodes. By the end of the week we will know which scenario plays out.

There will be lots of trading opportunities in the next few days. Keep your powder dry heading into the statement and line up your longs. I plan to buy the rally, but I will not short a decline. If we sell-off, I will wait for a capitulation low and then I will buy.

.

.

Daily Bulletin Continues...