Fed Trade – There Is Only One Scenario and One Trade I Would Do Instantly Today

IF YOU WANT MY COMMENTS BEFORE THE OPEN EVERY DAY - GET THE 1OPTION PLATFORM

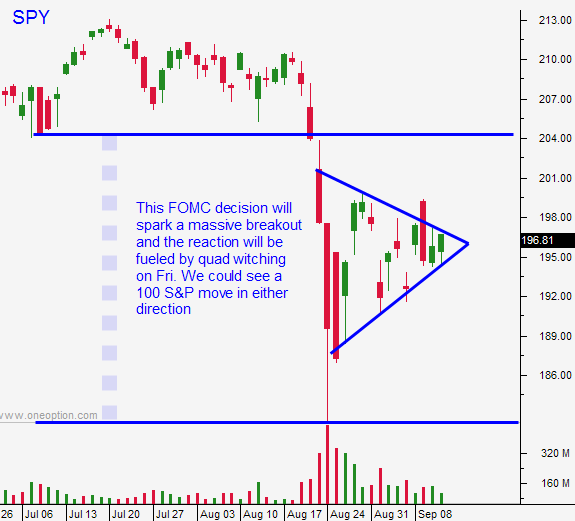

Posted 9:45 AM ET - The market has rallied almost 50 S&P points in the last 2 days. That has taken a lot of the upside out of the equation. If we gap 50 points higher on no hike, we will be at SPY $205. That is within striking distance of the all-time high and we know resistance is stiff there. Traders will instantly try to guess when the rate hike is going to happen. Every slip in China's econ will be an issue and the market bid will gradually erode. We will see a few good days of price action before that happens.

If the Fed raises rates .125%, that could be a very strategic move and I feel it is very possible. They will get the first one under their belt and the market is ready for it. The move will also be small so it won't impact economic growth and it will be a vote of confidence. If this plays out, I will instantly sell VXX. It will decline on the news initially, but not much because everyone will still be trying to handicap this move. Ultimately, the market could settle in right here if this happens and this would be a great trade.

The best scenario is a rate hike of 1/4 point. I doubt this will happen. The Fed loves to screw with shorts and this would favor bears. A Fed decision that sparks a decline would be irresponsible - right? The market can rally like mad and we can run credit up to the moon and that is not irresponsible – go figure. In the unlikely event we get a 1/4 point rate hike, the market will decline. Emerging markets will get hit hard and the dollar will rally. I will not short a decline. I will wait patiently for the dust to settle and I will not take my eye off of the prize. A major pullback would set up the best trade of the year and I will be lining up my longs. I will sell puts and buy calls once support is established

Quad witching will fuel this move. There will be an initial reaction, a reaction to the press conference 30 minutes after the statement and an overnight reaction. Expect lots of volatility. The move that settles the market the most would be a .125% hike

If you must trade, focus on liquid stocks with tight bid/ask spreads that have great relative strength early in the day and are breaking out.

All options are on auto-quote with market makers and they will keep them super wide all day. Bid/ask spreads will be as wide as the Grand Canyon.

Good luck!

.

.

Daily Bulletin Continues...