Market Will Explode 100 S&P Points – We Just Don’t Know Which Way

IF YOU WANT MY COMMENTS BEFORE THE OPEN EVERY DAY - GET THE 1OPTION PLATFORM

Posted 9:30 AM ET - I am going to keep my comments unchanged from yesterday. They will serve us well until the FOMC statement Thursday. Look for quiet trading. Once the range is established, look for reversals off of the extremes. Keep your size small.

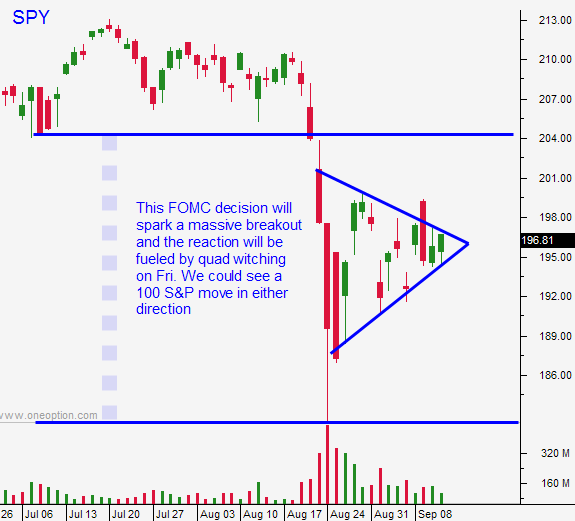

I posted a chart of the SPY. As you can see, a wedge has formed right in the middle of the trading range between SPY $182 and $205. The FOMC statement on Thursday will spark a massive move in one direction or the other and quadruple witching will add fuel to the fire on Friday. This is a binary event (hike or no hike) and I believe we could see a 100 point move in the S&P 500 before the close of trading on Friday.

This might come as a surprise, but I won't be very active. I will let this tsunami pass and I will find my opportunities once the dust settles.

During the initial move you can expect crazy moves. Some of you will enter a trade and feel like a hero. Minutes later the market will reverse and you'll feel like a fool. Bid/ask spreads will look like the Grand Canyon and option implied volatilities will remain high.

If the Fed hikes rates, the market will tank and I'm expecting a drop to SPY $182. This would be an ideal outcome. China's economy is weak, but it is not falling off of a cliff. Industrial production was a little soft over the weekend, but retail sales were decent (10.5%). China has cut rates, reduced bank reserve requirements; devalue the Yuan, purchased stocks, increased fiscal spending and reduced investment taxes. These actions will keep buyers engaged and I do not see a credit crisis unfolding in 2015. The Fed will soften the blow with "one and done" rhetoric and seasonal strength will attract buyers. Once support is established I will sell puts and buy calls. The S&P could rally 150 points into year-end.

If the Fed postpones a rate hike, the market will rally. It should hit resistance at SPY $205. Major technical damage has been done and the global macro outlook is fragile. Traders will wonder when the rate hike will occur and every word from every Fed official will be scrutinized. The debt ceiling could keep a lid on the rally and China's economic data will be monitored closely. Seasonal strength will keep buyers somewhat engaged, but the bid will be fragile. Stocks will gradually retrace, but they won't tank. In this scenario we would drift down to the middle of the trading range (right where we are now). I don't like shorting into year-end and we are still in a long-term bull market. For that reason, this scenario is less appealing. I also feel that the market is prepared for a rate hike and I would like to see the Fed take action.

I will be day trading ahead of the FOMC statement and I will be flat during the announcement. The market seems content in the middle of the range and I don't believe we will see any big moves. We will establish a trading range and test both extremes during the day. I will search for stocks that have relative strength/weakness. When the market reaches one end of the trading range, I will watch for a compression and a reversal. I will take the appropriate position and I will ride it until the momentum stalls. Use this hit and run strategy this week. I still favor trading from the long side.

If the market trends the entire day and it finishes on the high/low, look for a reversal the next day. I believe we have reached a temporary equilibrium point.

This is the calm before the storm. All hell will break loose Thursday and Friday. I will watch the market reaction very closely and I believe the best opportunities are a week away.

.

.

Daily Bulletin Continues...