Option Trading Strategy – Sell Bullish Put Spreads – Quiet Stretch Ahead

TAKE THE 1 WEEK FREE TRIAL AND FOLLOW OUR OPTION TRADES IN THE CHAT ROOM

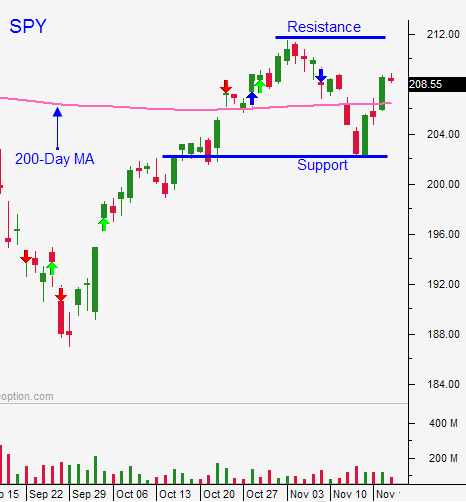

Posted 8:50 AM ET - Last week the FOMC minutes revealed that the Fed is ready to hike. A bullish reaction to these hawkish remarks suggests that the market is ready for liftoff. The S&P 500 rallied above the 200-day moving average and we saw follow-through buying on Friday.

The market is within striking distance of the all-time high and many Asset Managers have been reluctant buyers. Those who are under-allocated will grow anxious as stocks tread water. The bid will remain strong and the 200-day moving average will hold.

Thanksgiving will suck the life out of the market this week. Flash PMI's in Europe were better-than-expected and the data in the US should be in line. I don't see any speed bumps this week and stocks should have a slight upward bias. Any gains could quickly be stripped away.

If I recall correctly, the last few years the market has drifted higher Monday through Wednesday and pulled back on Black Friday. This is not a pattern I would trade, but I would focus on the aggregate effect. This will be a choppy light volume week and we are likely to finish right where we started.

When we return next week, the jobs report will be in focus. Barring a number below 150,000 (very unlikely), the Fed will prepare for a rate hike. A number above 200,000 would be bullish.

The market is prepared for a rate hike in December. Let's hope that the Fed does not screw this up. If they don't hike on December 16th, I believe the market will decline. From this point forward, good news will be good for the market and bad news will be bad for the market.

When the Fed does raise rates, they will soften the blow with "one and done" rhetoric. The market will like this and the S&P 500 will stage a year-end rally. I believe we will finish 2015 at a new all-time high.

We are currently in a holding pattern. First we will wait for Black Friday, then we will wait for the jobs report, and finally we will wait for the FOMC decision. This environment is perfect for premium selling. I believe the S&P 500 will hold the 200-day moving average through December options expiration. Under-allocated Asset Managers will buy dips and we can lean on that support.

I have been selling out of the money bullish put spreads on stocks that are breaking out. I will use that breakout as my stop. As long as the SPY stays above $207, I will focus on this options trading strategy. Distance yourself from the action and take advantage of time decay.

I will do some day trading this week, but my size will be small. The action will dry up and I won't have a market tailwind to fuel intraday moves. Most of my trading take place in the first few hours and I don't plan on trading Friday.

Sell out of the money bullish put spreads and look for the market to fall into a trading range while we wait for the FOMC.

Expect choppy price action with little overall movement this week.

.

.

Daily Bulletin Continues...