Sell Bullish Put Spreads – Support Is Strong and Next Week Will Be Dull

TAKE THE 1 WEEK FREE TRIAL AND FOLLOW OUR OPTION TRADES IN THE CHAT ROOM

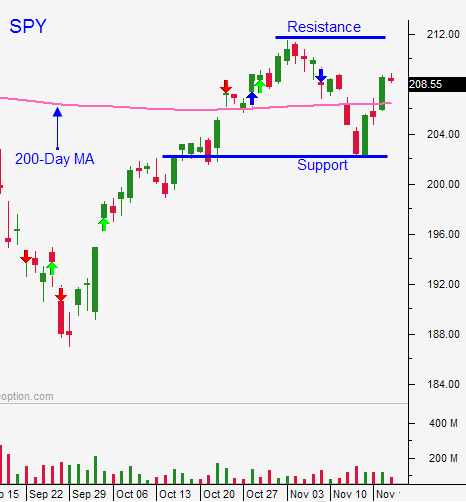

Posted 8:50 AM ET - Thursday the market took a breather after a huge rally Wednesday. The SPY broke through the 200-day moving average and we are within striking distance of the all-time high. Asset managers have been reluctant to buy this rally and many are under-allocated. I believe there is stock to buy and the bid should remain strong.

The market is prepared for a quarter-point rate hike in December. In the grand scheme of things, this is a tiny move and it won't have much of an impact on economic activity. If the Fed starts now they can keep the trajectory low. This is another way of saying "one and done". That type of language in December would spark a rally and I believe we will take out the all-time high if we get it.

Thanksgiving will suck the life out of the market next week and I plan to use that to my advantage. I want to sell out of the money bullish put spreads today. Stocks will chop around next week and any bias will favor the upside. Time decay will whittle away at these options and I am confident that the market will hold its 200-day moving average.

I bought November calls on Wednesday and I will be selling them for a nice profit today.

Focus on stocks that are breaking through horizontal resistance. Use that breakout as your stop.

When we get back from Thanksgiving, the jobs report will be in focus. I'm expecting a decent number and it should cement the December rate hike. After that, we will be in a holding pattern until the FOMC statement on December 16th.

This forecast is ideal for bullish put spreads. Pick strong stocks with defined support levels and sell strikes that are below that support. Take advantage of strong market support and time decay.

November options expire today and you can expect choppy action with an upward bias.

.

.

Daily Bulletin Continues...