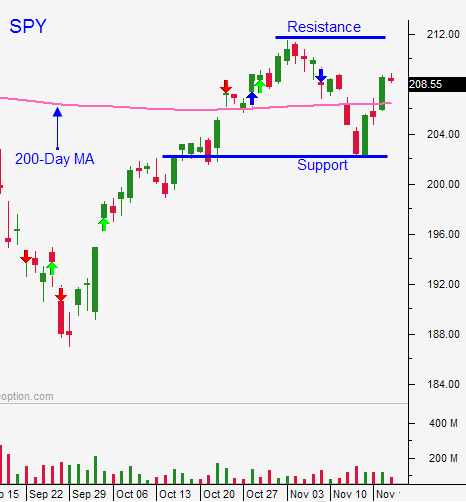

Sell Bullish Put Spreads On This Dip – 200-Day MA Will Hold

TAKE THE 1 WEEK FREE TRIAL AND FOLLOW OUR OPTION TRADES IN THE CHAT ROOM

Posted 9:30 AM ET - Thanksgiving is going to suck the life out of the market this week. When we come back, the focus will be on the jobs report. After that, we will wait for the FOMC statement on December 16th. We are in a holding pattern for the next few weeks and the 200-day moving average will hold.

Turkey shot down a Russian fighter jet after warning it many times. This news has sparked some selling, but it won't have a lasting effect.

If this move gains traction, it will be due to a lack of buying (not heavy selling).

I will be selling out of the money put credit spreads (a.k.a. bullish put spreads) on strong stocks. Mega cap tech stocks (Facebook, Netflix, Amazon, and Google) have been leading this rally and they will be the best candidates. Sell the puts below technical support. If support is breached, buy the option spread back. Otherwise, let time decay eat away at the option premiums.

If I day trade today, it will be in the first two hours of trading. I will favor the long side and I will take profits quickly.

This is a time to keep your trade count down and your size small. Distance yourself from the action and sell out of the money bullish put spreads. Let the market chop back and forth while it waits for the Fed.

The downside will be tested early today and buyers should keep the damage to a minimum. Once support is established, we should recover most of the losses.

.

.

Daily Bulletin Continues...