Sell Put Credit Spreads – Place Stops – Spend Time With Your Family

TAKE THE 1 WEEK FREE TRIAL AND FOLLOW OUR OPTION TRADES IN THE CHAT ROOM

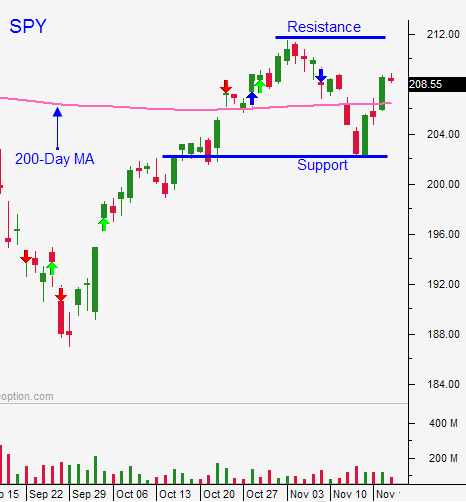

Posted 10:45 AM ET - Yesterday the market declined after a Russian fighter jet was shot down over Turkey. Stocks probed for support and buyers quickly stepped in. This price action tells me that the bid is still strong.

Asset Managers have been reluctant to buy this rally and I suspect they are under allocated. They will buy dips and the 200-day moving average will hold until the FOMC on December 16th. Yesterday we did not get close to challenging it before buyers stepped in.

We will get inundated with economic releases next week. They include official PMI's, ISM manufacturing, ISM services, ADP, the Beige Book and the jobs report. It is a foregone conclusion that the news will be "good enough" to justify a December rate hike. That means we need strong economic data to fuel a breakout.

The releases will be decent, but they will not tempt buyers. The market will remain in a holding pattern until the FOMC.

If I recall correctly, the market typically rallies into Thanksgiving, declines on Black Friday and rallies on Cyber Monday. I don't consider this pattern strong enough to trade so I did not research it. The point is, we will chop around and there will be not be much movement once the dust settles.

This is a great environment to sell out of the money put credit spreads (a.k.a. bullish put spreads). Focus on strong stocks and sell options below technical support. As long as that support holds, let time decay eat away at the premiums. This strategy will allow you to distance yourself from the action and to generate income while you wait for the FOMC statement.

The 200-day moving average will hold and trading volumes will be light the rest of the week.

Enter your bullish put spreads, place your stops and enjoy time with your family. This is what I plan to do and I will be taking Friday off.

Happy Thanksgiving!

.

.

Daily Bulletin Continues...