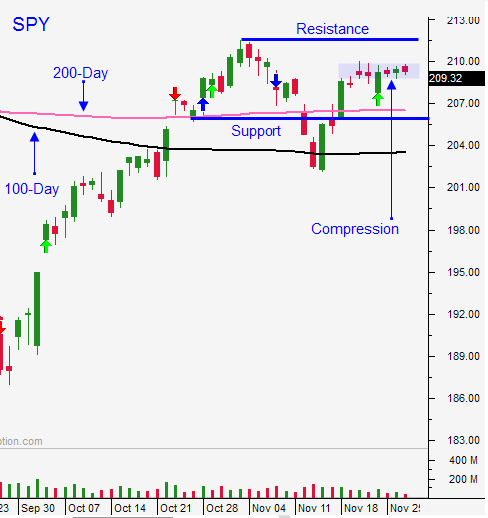

SPY Will Trade Between $207 and $212 – Sell OTM Bullish Put Spreads

Posted 9:50 AM ET - The market has been flat-lining the last week and major economic releases will breathe life back into it in the next few days. From this point on we need strong economic data. The Fed is going to raise interest rates in two weeks and improving activity would support their decision.

China will post its official PMI tonight. They no longer provide a flash PMI so this number carries more weight. Conditions should be stable, but sluggish. I'm expecting the Yuan to be added as a reserve currency by the IMF today. That should help China's market.

ISM manufacturing will be posted tomorrow. The results will be a little light. Economic releases the remainder of the week should be decent.

The jobs report on Friday should come in around 200,000. A number below 150,000 would be bearish and a number above 250,000 would be bullish. For the rest of the year, good news is good news and bad news is bad news.

Traders are prepared for a rate hike and I hope the Fed does not screw this up. The FOMC statement is likely to include a reference to "one and done". This will soften the blow and the market should rally on the news.

Until then, the SPY will trade between the 200-day moving average and the all-time high. We will see a sharp little news related moves that quickly stall. There will not be any follow-through and they will be impossible to predict.

This type of environment sets up well for bullish put spreads. I want to lean on the 200-day moving average and seasonal strength. This is really the only swing trade worth considering. I will focus on strong stocks and I will sell put options below technical support. I will use that technical support as my stop.

I will also day trade using the one hour range as my guide. If the market is above the high, I will focus on longs. If the market is below the low, I will look for shorts. Once the daily momentum is established, we tend to see follow-through the rest of the day. If we are caught inside of the one hour range, I will keep my day trading to a minimum.

The only move that would spark my interest is a decline to the 200-day moving average before the FOMC. If this happens, I will be a little more aggressive with my long positions.

I am trading one third of my normal size. This is a low probability trading environment.

Sell bullish put spreads and look for increased activity towards the end of the week.

.

.

Daily Bulletin Continues...